Understanding What Is TDS?

The Indian government created the Tax Deducted at Source (TDS) system, which deducts a specific amount of taxes at the source of earning. You are responsible for claiming the remaining money after this deduction is submitted directly to the government on your behalf. TDS is applicable to a range of income, including commissions, rent, interest from bank accounts, salaries, and real estate sales.

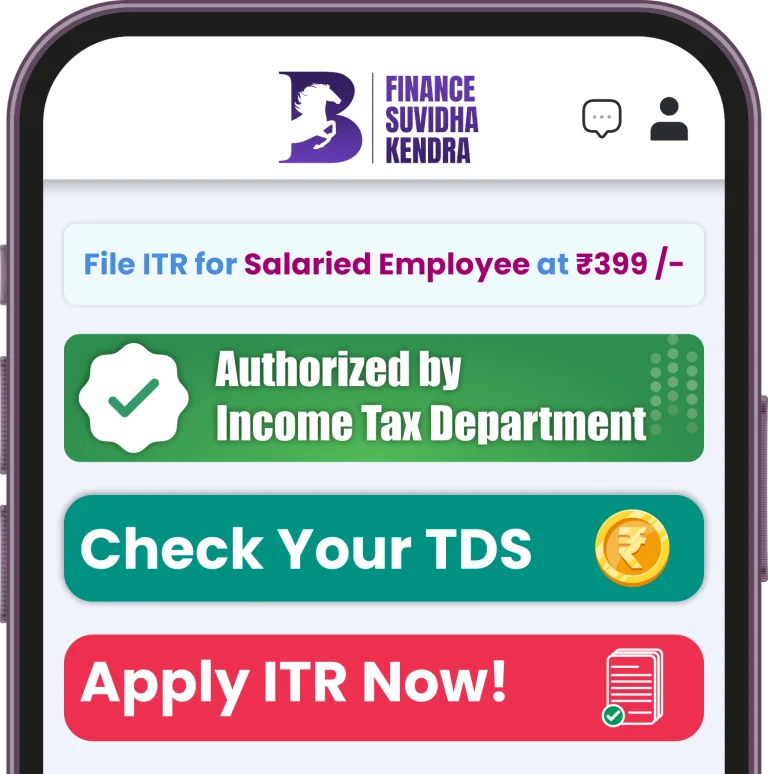

You’re not the only one who doesn’t know how much TDS has been deducted from your earnings. We’ve made it easier by creating a Free TDS Checking Tool that enables you to quickly and precisely verify your TDS information.

How To Use Free Online TDS Checking Tool?

We are aware that monitoring your TDS might be time-consuming. A straightforward method to see how much TDS has been deducted from your sources of income is to use our Free TDS Checking Tool. With just a few clicks, you can quickly view your TSD Refund Amount, including commissions, bank interest, rent, and TDS on your pay. Steps For Checking TDS Refund:

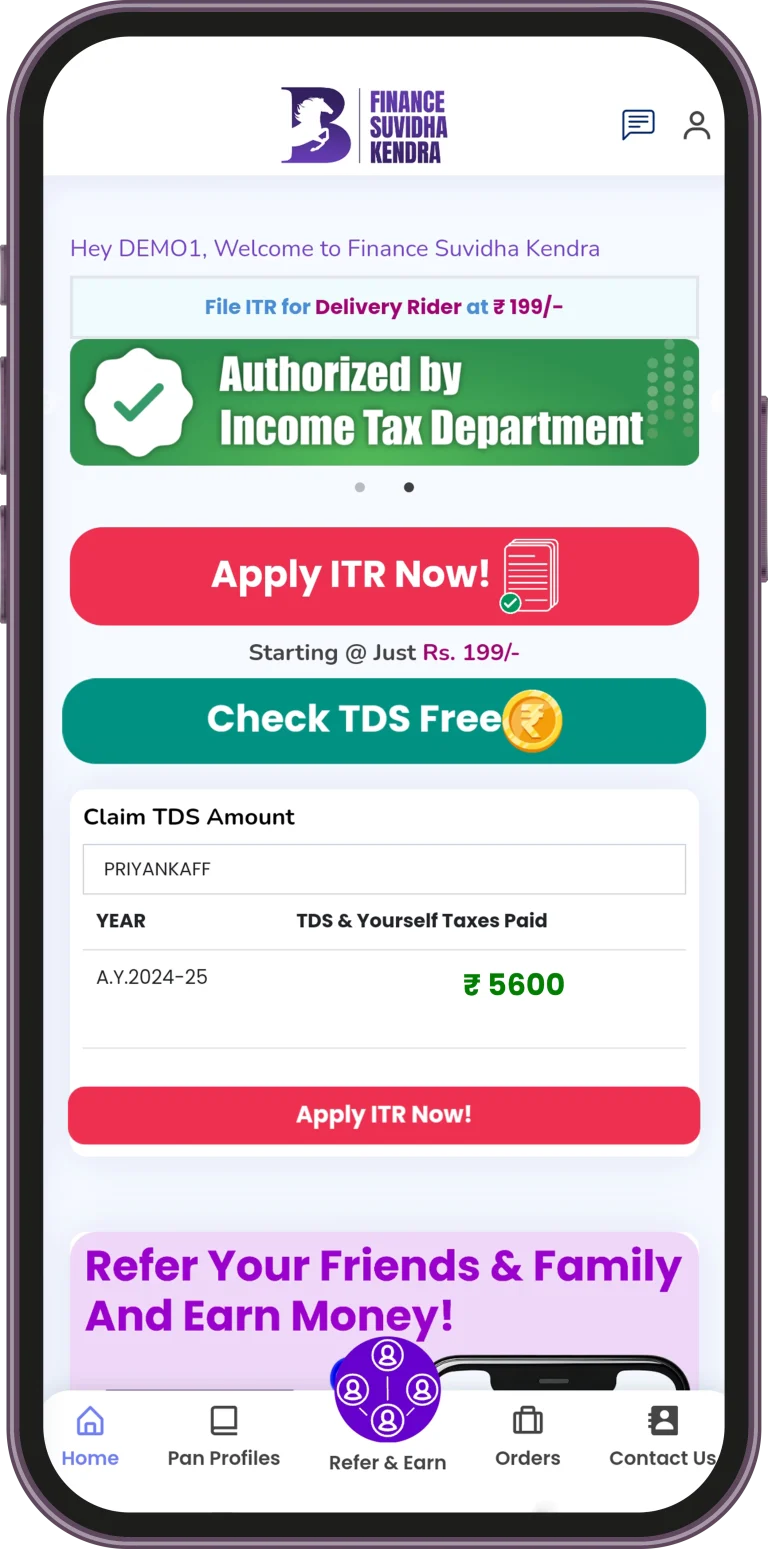

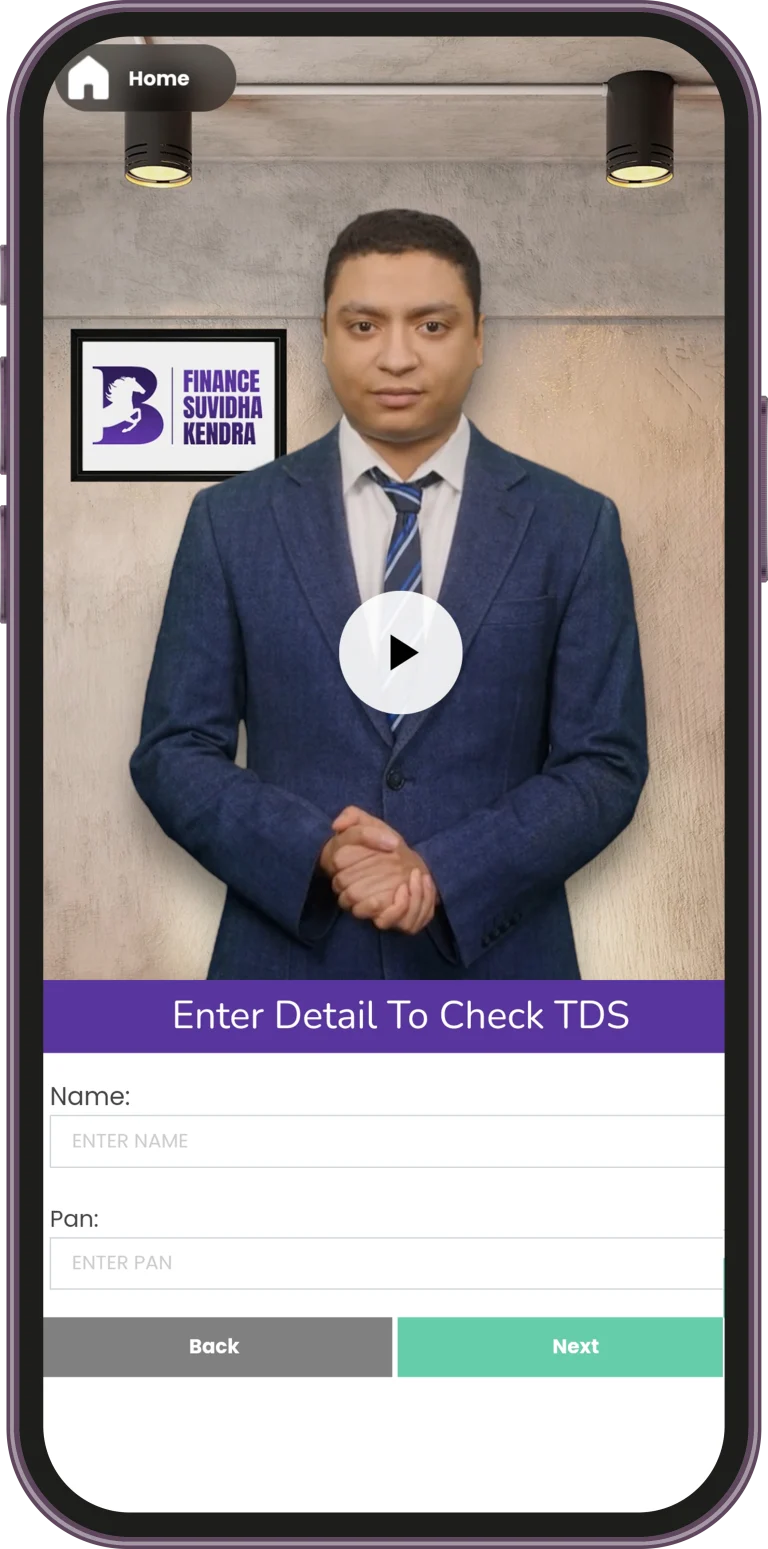

- “Download” & “Login” Finance Suvidha Kendra App.

- Open App & Click On The “Check TDS Button”.

- Add Some Basic Details & Press “TDS Check Button”.

You may use our app to file your ITR (Income Tax Return) if you’re happy with your TDS records. Let us take care of the details, you don’t need to worry about them.

How TDS Works on Different Incomes?

Here’s a breakdown of how TDS applies to various types of income:

1. TDS on Salary:

Employers are required to deduct TDS from employees’ salaries as per the income tax slabs. The rates depend on the individual’s salary and applicable tax deductions like HRA, PF, and 80C exemptions.

For Example:

If you earn a salary of ₹10,00,000 annually and you are in the 20% tax bracket, your employer will deduct a certain percentage monthly towards TDS and remit it to the government. You can check the total deducted amount using our TDS tool.

2. TDS on Bank Interest:

Banks deduct TDS at 10% on interest earned from fixed deposits if the total interest exceeds ₹40,000 in a financial year (₹50,000 for senior citizens). However, if you do not submit your PAN, the TDS rate is 20%.

Example Calculation:

If your FD earns ₹1,00,000 in interest in a year, the bank will deduct ₹10,000 as TDS (at 10%). You can claim this when filing your tax return, and if your total tax liability is less, you can request a refund.

3. TDS on Rent:

You must deduct 5% TDS from the total amount of rent paid in a fiscal year if your monthly rent exceeds ₹50,000. It is your responsibility as the renter, not the landlord, to deposit this TDS with the government.

Example:

For a monthly rent of ₹60,000, the annual rent will be ₹7,20,000. The TDS to be deducted would be 5% of ₹7,20,000, which is ₹36,000.

4. TDS on Sale of Property:

If you buy a property worth more than ₹50 lakh, you need to deduct 1% TDS from the payment made to the seller. This TDS must be deposited with the government.

Example:

On a property worth ₹70,00,000, you must deduct 1% TDS, i.e., ₹70,000, and deposit it.

5. TDS on Commission:

Commission payments above ₹15,000 attract TDS at the rate of 5%. This applies to any kind of brokerage or commission earned, whether you are a real estate agent or working on commission-based sales.

Example:

If you earn ₹50,000 in commission, the company paying you will deduct ₹2,500 (5%) as TDS before making the payment.

TDS Rates and Thresholds at a Glance

| Income Type | TDS Rate | Threshold Limit |

| Salary | Based on income tax slabs | No limit |

| Bank Interest (FD) | 10% | ₹40,000 (₹50,000 for seniors) |

| Rent | 5% | ₹50,000 per month |

| Sale of Property | 1% | ₹50,00,000+ property value |

| Commission | 5% | ₹15,000+ commission |

| Contractor Payments | 1% to 2% | ₹30,000 (Single contract) or ₹1,00,000 aggregate |

Why is TDS Important?

TDS is a way for the government to collect taxes at the source of income generation, ensuring regular tax inflow and reducing tax evasion. As a taxpayer, it’s essential to track your TDS for the following reasons:

Accurate Tax Filing: Ensuring the correct amount of TDS helps avoid underpayment or overpayment of taxes.

Refunds: If excess TDS has been deducted, you can claim a refund when filing your ITR.

Compliance: Failing to deduct or pay TDS can lead to penalties.

Our Free TDS Checking Tool ensures that you can stay on top of these deductions without any hassle.

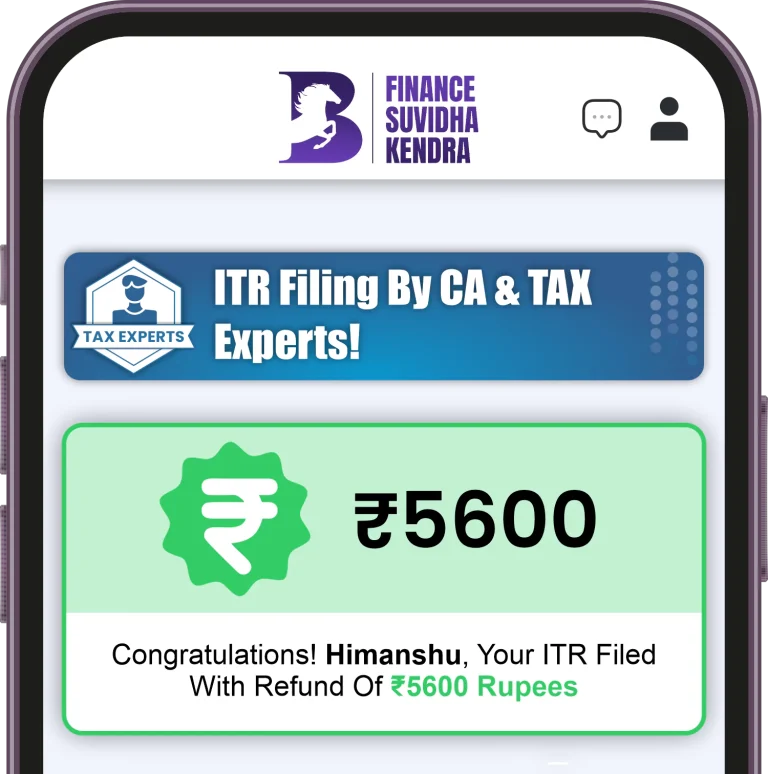

File Your ITR with Our CA's & TAX Experts!

Once you’ve checked your TDS details using our free tool, the next step is to file your Income Tax Return (ITR). Filing your ITR helps you claim any TDS refunds you might be eligible for, and ensures that you remain tax-compliant. With our app, you can easily:

- File Your ITR in just a few steps.

- Claim Your Deducted TDS without any complexities.

- Maximize Your Refund with expert guidance.

Download our app now and make tax filing easy, accurate, and stress-free!

Conclusion - Check TDS

In conclusion, TDS is a crucial aspect of your income and tax compliance. By using our Free TDS Checking Tool, you can easily keep track of how much tax has been deducted and make sure everything is in order before filing your tax return. And with our app, filing your ITR and claiming your rightful refund has never been easier!

FAQ's - Check TDS

1. How To Check TDS Online?

To check your TDS online, you can follow these simple steps:

- Visit our Free TDS Checking Tool.

- Enter your PAN number.

- Select the relevant financial year.

You will instantly see the details of your TDS deducted across various sources like salary, interest, rent, or commission.

Alternatively, you can check your TDS on the government’s income tax portal by logging into your account and downloading Form 26AS.

2. How To Check TDS Amount?

To check the amount of TDS deducted:

- Use our Free TDS Checking Tool by entering your PAN and financial year.

- The tool will display the total TDS amount deducted by various deductors (employer, bank, etc.).

- You can also refer to your Form 26AS on the income tax e-filing website for a detailed breakdown of the TDS deducted throughout the year.

3. How To TDS Check By PAN Card?

Checking your TDS using your PAN card is straightforward:

- Open our TDS Checking Tool.

- Enter your PAN number, and some basic details. (which is linked to your TDS records)

- Select the financial year, and the tool will fetch all the details of TDS deducted against your PAN.

4. How Can I Check My TDS Refund Status?

To check the status of your TDS refund:

- Log in to the income tax e-filing portal with your PAN.

- Navigate to the “Income Tax Returns” section and select “View Returns/Forms”.

- Select the option for Income Tax Returns and choose the relevant assessment year.

- The refund status (whether it’s processed, refunded, or pending) will be displayed on the screen.

You can also track your refund status on the TIN NSDL website by entering your PAN and the relevant assessment year.

5. How To Check TDS Refund Status?

To check the TDS refund status, follow these steps:

- Visit the income tax e-filing portal or the TIN NSDL website.

- Log in with your PAN or simply enter your PAN and the assessment year.

- You’ll be able to see whether your refund has been processed or if it's still pending.

In case your refund is delayed, you can contact the income tax department for more details or track it through their official portals.