SMALL SHOPS AND BUSINESS ITR Filing by CA @ ₹499/-

File ITR Online for last 3 Year of Business and Shops, Restaurants, Offices etc. through CA and Tax Experts. Filing your ITR is mandatory if your annual Income exceeds Rs 2,50,000/-. There is No (Zero) Income Tax on Annual Income upto Rs 7,00,000/-

अब CA द्वारा INCOME TAX RETURN फाइल करें आसानी से

Our CA will file your Income Tax Return after discussing your Income details with you on phone.

More than 30000Women Business Ownerfiled ITR through FSKIndia

More than 30000Women Business Ownerfiled ITR through FSKIndia

Aarti Kapadia!

Crockery Store Owner from Indore!

- Maine apna ITR FSKIndia se aasani se file krwa liya. Sari details FSKIndia ke Tax Experts se phone pe discuss krke file ho gyi. Mujhe koi bhi document submit nhi krne pde.

More than 40000Small Shops Ownerstrust FSKIndia for ITR Filing

More than 40000Small Shops Ownerstrust FSKIndia for ITR Filing

Anil Sharma!

Grocery Shop Owner from Karnal!

- I filed my last 3 years Business ITR with FSKIndia with just some clicks on mobile app. My loan got approved after filing ITR from FSKIndia.

More than 30000Women Business Ownerfiled ITR through FSKIndia

More than 30000Women Business Ownerfiled ITR through FSKIndia

Aarti Kapadia!

Crockery Store Owner from Indore!

- Maine apna ITR FSKIndia se aasani se file krwa liya. Sari details FSKIndia ke Tax Experts se phone pe discuss krke file ho gyi. Mujhe koi bhi document submit nhi krne pde.

More than 30000Women Business Ownerfiled ITR through FSKIndia

More than 30000Women Business Ownerfiled ITR through FSKIndia

Aarti Kapadia!

Crockery Store Owner from Indore!

- Maine apna ITR FSKIndia se aasani se file krwa liya. Sari details FSKIndia ke Tax Experts se phone pe discuss krke file ho gyi. Mujhe koi bhi document submit nhi krne pde.

More than 40000Small Shops Ownerstrust FSKIndia for ITR Filing

More than 40000Small Shops Ownerstrust FSKIndia for ITR Filing

Anil Sharma!

Grocery Shop Owner from Karnal!

- I filed my last 3 years Business ITR with FSKIndia with just some clicks on mobile app. My loan got approved after filing ITR from FSKIndia.

Business owner gotIncome Tax Refundby filing ITR with FSKIndia

Business owner gotIncome Tax Refundby filing ITR with FSKIndia

Rashmi Malhotra!

Boutique Owner from Chandigarh!

- Finance Suvidha Kendra se ITR file krke maine apna Income Tax Refund just 15 days mei receive krliya. Meri ITR CA ne file kri vo bhi just Rs 499/- mein.

Benefits of Shops and Business ITR Filing with FSKiNDIA

Why should Shops and Business File ITR

Filing your ITR is mandatory if your annual Income exceeds Rs 2,50,000/-. There is no Income Tax on Annual Income of Rs 7,00,000/- Other Benefits of Filing ITR are mentioned below:

Claim INCOME TAX REFUND

Shops and Business can get their TDS back into their Bank account. File Business ITR with Finance Suvidha Kendra and get maximum Income Tax Refund.

VISA PURPOSE

Embassies and Immigration consultant demands 3 years Business Income Tax Return. File 3 years Business ITR with Finance Suvidha Kendra

LOAN APPLICATION

Banks demands 3 years Business Income Tax Return to process Loan Applications . File 3 years Business ITR with Finance Suvidha Kendra

INCOME PROOF

Business ITR act as proof of your Income. which can be used in Insurance claims, buying High Value Properties etc. File Business ITR with Finance Suvidha Kendra

TAX COMPLIANCE

As per Income Tax Rules if your annual Income is more than ₹ 2,50,000/- , Shops and Business are required to file their Income Tax Return. File Business return with Finance Suvidha Kendra

Cash deposit Income Tax

Business ITR act as proof of your Income. which can be used in Insurance claims, buying High Value Properties etc. File Business ITR with Finance Suvidha Kendra

Can I File Last 3 Year of ITR Shop and Business ?

With FSKIndia you can file last 3 year ITR - Income Tax Return of Shop and Business altogether.

Business and Shops ITR filing

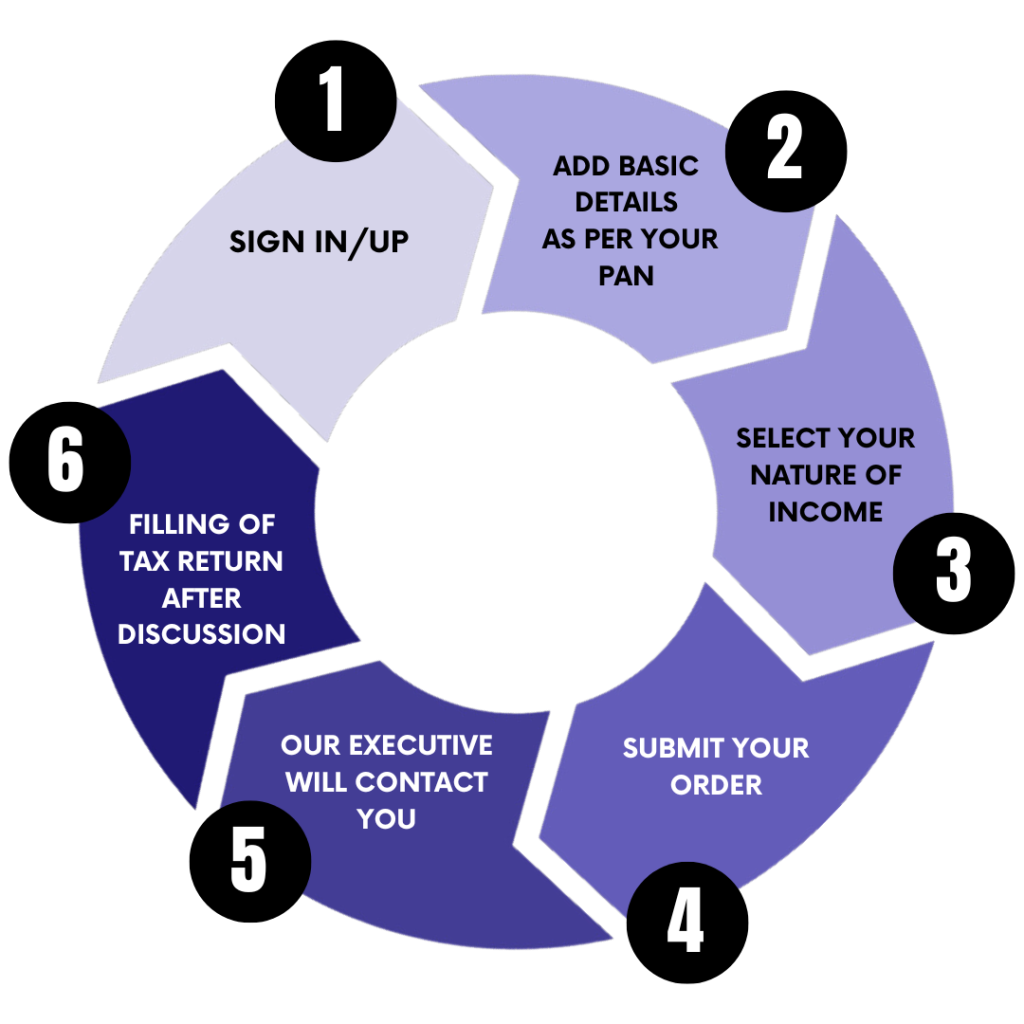

6 Simple Steps to E-File your Income Tax Return for Shop and Business

01

Step 1: SIGN In/Up at FSKIndia app

02

Step 2: ADD BASIC DETAILS AS PER YOUR PAN for ITR FILING

03

Step 3: SELECT YOUR NATURE OF INCOME

04

Step 4: SUBMIT YOUR ITR FILING ORDER

05

Step 5: OUR EXECUTIVE WILL CONTACT YOU FOR ITR FILING

06

Step 6: ITR FILING BY CA AFTER DISCUSSION WITH YOU

Frequently Asked Questions on Shops and Business ITR

Finance Suvidha Kendra Income Tax Return Services For: Shops and Business ITR

As per Income Tax rules, Every Shop owner, Self employed, Offices , Free Lancers and all those who earn more than Rs 250000/- in a year are required to file their Income Tax RETURN.

Only, Shopkeeper , Self Employed or Business who are registered under GST are required to submit their GST details while filling Income Tax Return.

Yes, to apply for all types on Loan you need ITR-Income Tax Return. Tax experts and CA's at FSK India File Income Tax Return according to requirments of Banks.

Yes, to apply for all types on Visa Application you need ITR-Income Tax Return. Tax experts and CA's at FSK India File Income Tax Return according to requirments of Immigration deaprtments.

Don't worry our Tax experts are always here for you. To file ITR for Shop and Business you have to provide only basic details and rest of the work for ITR Filing Online will be done by CA and Tax Experts of FSKIndia.

As per Income Tax guidelines no Tax is applicable upto Income of Rs 700000/-. If your Income is upto Rs 700000/- you can get full refund of the TAX deducted.

It is dependent on Income Tax Department. In normal cases the Income Tax Department credit Income Tax Refund in 3 to 7 days. However in complex cases it may take upto 3 to 6 months.

Is your Income Tax refund stuck?

Get in touch with our Tax Experts to help you get your refund Faster.

Shop and Business need to provide only basic details and documents to Finance Suvidha Kendra for ITR Filing as mentioned below:

- PAN Card

- Aadhaar Card

- Bank account details

All the remaining details will be discussed by CA's and Tax experts of FSKIndia on call.

Contact Us

Love to Hear from You, Get In Touch

We're here to assist you every step of the way.

- (0175) 5031685

- FSK.BBMS@GMAIL.COM

- 1070/2, B.H. COMPLEX , TRIPURI , PATIALA-147001.