TAX REFUND FOR AMAZON FLEX COURIER DELIVERY PARTNERS

Tax Refund for Amazon Flex Delivery Partners

ITR Filing through CA allows Amazon Flex Delivery Partners to quickly get Income Tax Refunds @ just ₹399/- TAX Refund for Amazon Flex Delivery Partners

अब CA द्वारा INCOME TAX RETURN फाइल करें आसानी से

Our CA will file your Income Tax Return after discussing your Income details with you on phone.

Tax Refund for Amazon Flex More Than₹50 Croreby filing ITR with FSKIndia

Tax Refund for Amazon Flex More Than₹50 Croreby filing ITR with FSKIndia

Ankit Kumar

Amazon Flex Delivery Partner from New Delhi!

- Finance Suvidha Kendra ki madat se maine, apne Income Tax Refund ko sirf 15 dinon mein easily prapt kiya jo ki mera Amazon flex me 1% deduct hua tha. Thanks to Finance Suvidha Kendra

More Than10,000+Amazon Flex Delivery Partners Got ITR Refund!

More Than10,000+Amazon Flex Delivery Partners Got ITR Refund!

Rahul Dixit

Amazon Flex Delivery Partner From Ahmedabad.

- Maine Finance Suvidha Kendra ke saath apna Income Tax Return file karke turant apna Income Tax Refund sirf 15 dinon mein prapt kiya. Aur saath hi, CA ne meri ITR sirf Rs 499/- mein file ki.

Tax Refund for Amazon Flex More Than₹50 Croreby filing ITR with FSKIndia

Tax Refund for Amazon Flex More Than₹50 Croreby filing ITR with FSKIndia

Ankit Kumar

Amazon Flex Delivery Partner from New Delhi!

- Finance Suvidha Kendra ki madat se maine, apne Income Tax Refund ko sirf 15 dinon mein easily prapt kiya jo ki mera Amazon flex me 1% deduct hua tha. Thanks to Finance Suvidha Kendra

More Than10,000+Amazon Flex Delivery Partners Got ITR Refund!

More Than10,000+Amazon Flex Delivery Partners Got ITR Refund!

Rahul Dixit

Amazon Flex Delivery Partner From Ahmedabad.

- Maine Finance Suvidha Kendra ke saath apna Income Tax Return file karke turant apna Income Tax Refund sirf 15 dinon mein prapt kiya. Aur saath hi, CA ne meri ITR sirf Rs 499/- mein file ki.

How Much Tax Refund for Amazon Flex Delivery Partners can Get?

Courier Delivery Service Companies Deducts 1 % Tax from Your Payouts. Now Get Tax Refund for Amazon Flex Delivery Partners.

For Example: Tax Refund for Amazon Flex

Assuming Amazon Flex Delivery Partners' annual payout is ₹3,50,000,Your TDS @ 1 % will be Rs 3500/-

Annual Payout

₹1,00,000/-

₹2,50,000/-

₹4,00,000/-

Deducted TAX

₹1,000/-

₹2,500/-

₹4,000/-

TDS Calculator - Tax Refund For Amazon Flex

Enter your Payout to find out the amount of TDS deducted by Amazon Flex

Want to Get Refund of the TDS ?

Click on the button below and File your Income Tax Return Our team of Tax Experts will file your ITR and get your Tax refund in your Bank Account

TAX REFUND For Amazon Flex Delivery Partners NOW

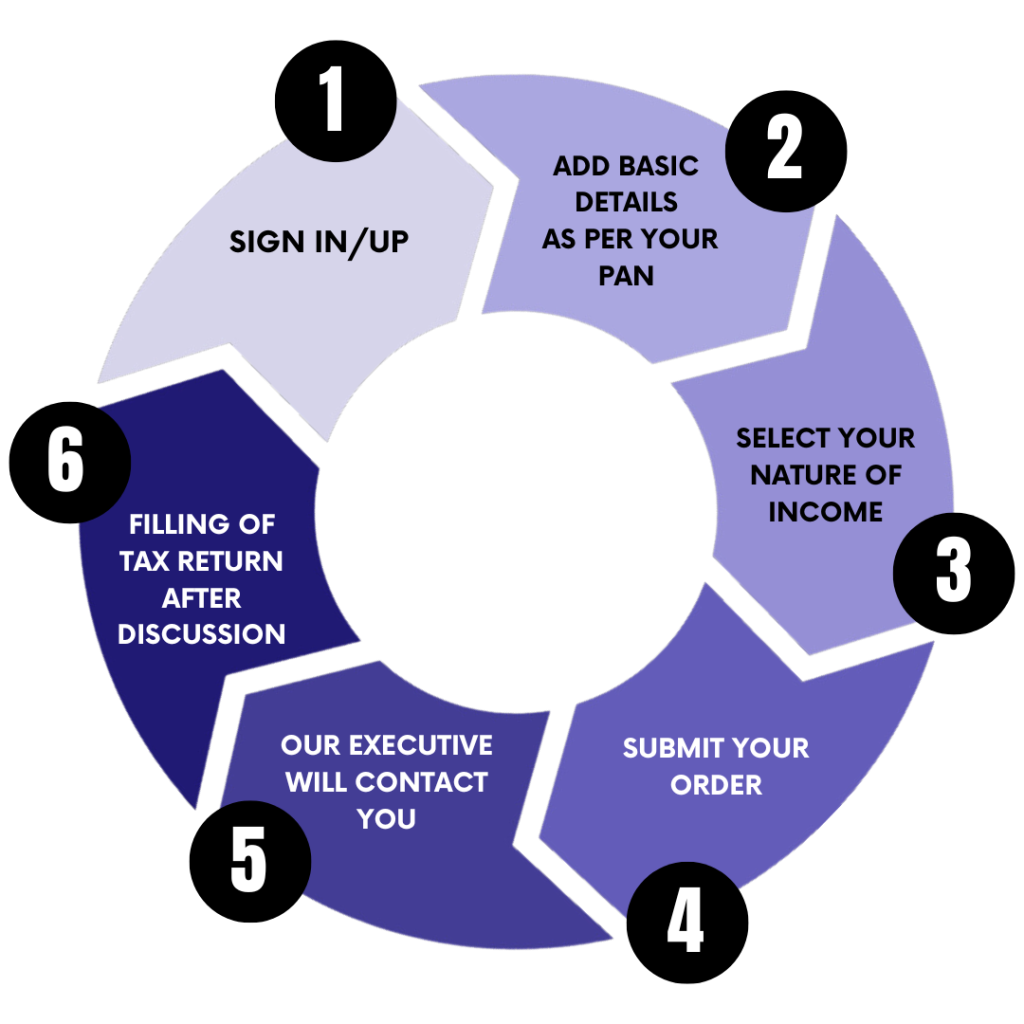

6 Simple Steps to E-File your Income Tax Refund for Amazon Flex Delivery Partners

01

Step 1: SIGN In/Up for Tax Refund

02

Step 2: ADD BASIC DETAILS AS PER YOUR PAN for ITR FILING

03

Step 3: SELECT YOUR NATURE OF INCOME

04

Step 4: SUBMIT YOUR ITR FILING ORDER

05

Step 5: Our Tax Experts will contact your for ITR filing

06

Step 6: ITR FILING BY CA AFTER DISCUSSION WITH YOU

Provide only PAN- Aadhaar details, Other details will be discussed by CA & Tax Experts on PHONE

Claim TAX REFUND for Amazon Flex Delivery Partners by Filing ITR Online.

Benefits Of Filing Income TAX Refund for Amazon Flex Delivery Partners

Why should Amazon Flex Delivery Partners file their ITR?

Filing your ITR ensures legal compliance and financial transparency. Here are the reasons and benefits of filing ITR:

TAX REFUND FOR AMAZON FLEX

File ITR Online and Get TAX Refund in Your Bank Account for Amazon Flex Delivery Partners. Get maximum Income Tax Refund by filing ITR From Finance Suvidha Kendra.

VISA PURPOSE

An Embassy or Immigration Consultant may require three years of Income Tax Returns. Please submit these three years of Income Tax Returns from the Finance Suvidha Kendra.

LOAN APPLICATION

To process loan applications, banks need 3 years of Income tax returns. File them with Finance Suvidha Kendra

INCOME PROOF

ITR can be used for insurance claims, purchasing high value properties, etc. File the Amazon Flex ITR with Finance Suvidha Kendra.

TAX COMPLIANCE

Amazon Flex Delivery Partner who earns more than ₹2,50,000/- per year is required to file their Income Tax Return with Finance Suvidha Kendra.

Frequently Asked Questions On Tax Refund For Amazon Flex Delivery Partners

Finance Suvidha Kendra Income Tax Return Services : TAX REFUND for Amazon Flex Delivery Partners.

1% TDS is deducted from Amazon Flex's delivery partner's payout. For example, if their payout was Rs 100000/-, the tax deducted by Amazon flex would be Rs 1000/-.

Tax Refunds can be claimed by Amazon Flex Riders by filing their Income Tax Return once a year. File Tax Return at FSK India only at the price of ₹399/-

The following steps can be followed to claim the Amazon Flex Delivery Partners' income tax refund.

Log in to the Finance Suvidha Kendra app.

Provide your basic PAN details.

As a Amazon Flex delivery partner, select your nature of income.

Place your order now.

An executive from Finance Suvidha Kendra will contact you.

After discussions with Amazon Flex Delivery Partners, the CA filed its income tax return.

You can check your tax deducted by Amazon Flex by providing basic details here. Click here to check TDS for free.

We have team of CA's and Tax experts with over 15 years of experience. Our dedicated experts prepare your ITR with applicable laws to ensure that you save maximum tax and get maximum TDS refund.

Yes, Finance Suvidha Kendra is authorised E-return intermediary(ERI) of Income Tax Department.

It is dependent on Income Tax Department. In normal cases the Income Tax Department credit Income Tax Refund in 3 to 7 days. However in complex cases it may take upto 3 to 6 months.

Is your Income Tax refund stuck?

Get in touch with our Tax Experts of Finance Suvidha Kendra to help you get your Amazon Flex refund Faster.

Get in touch with Tax Experts of Finance Suvidha Kendra to help you get your Amazon Flex Tax refund Faster.

Contact Us

Love to Hear from You, Get In Touch

We're here to assist you every step of the way.

- (0175) 5031685

- FSK.BBMS@GMAIL.COM

- 1070/2, B.H. COMPLEX , TRIPURI , PATIALA-147001.

- This Offer Is Available for all CSC Centers And Internet cafe's

Latest Offer! File Your First ITR at Just ₹1/- Only...

- FLAT 50% OFF for Retailers Self ITR