FINANCE SUVIDHA KENDRA

Income Tax-ITR Filing By CA

Tax Filing /Refund -

Finance Suvidha Kendra is authorised by Income Tax Department to provide easy and affordable Income Tax Return filing service to all the Indians

अब CA द्वारा INCOME TAX RETURN फाइल करें आसानी से

We Are Expert In ITR Filing

Claim Income Tax Refund

Tax Refund for Delivery Partners

• Zomato/Swiggy Delivery Partners

• Amazon Flex /E-kart Delivery Partner

• Ecomm Express

Salaried Employees

• Claim Tax Refund deducted by Employer

• Tax Compliance

• Discuss with CA

Shopkeepers/ Business

• Tax Compliance

• TDS Refund

• Business Proof

• Discuss with CA

OLA / UBER / RAPIDO

• Claim Tax Refund deducted by OLA/UBER/RAPIDO

• Tax Compliance

• Discuss with CA

File Your ITR Now

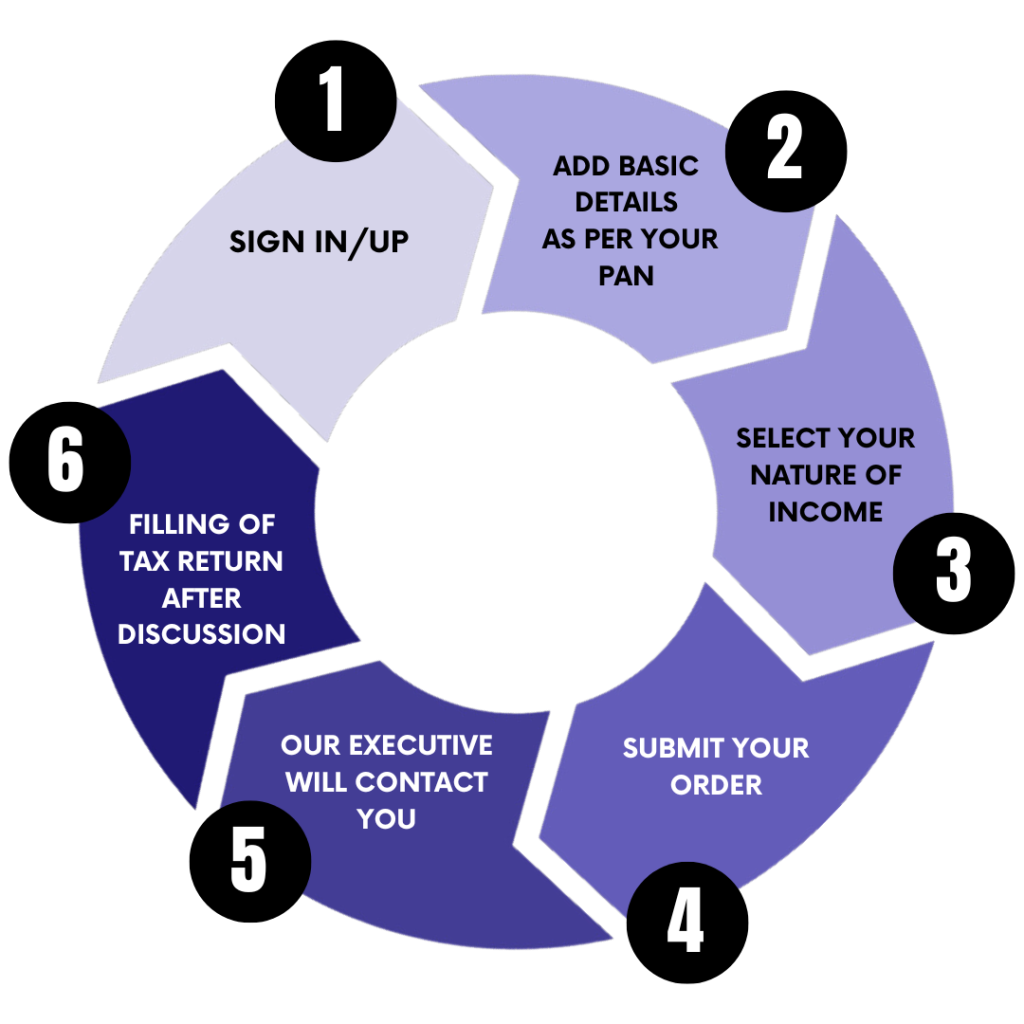

6 Simple Steps to get ITR E-Filed after discussion with CA

01

Step 1: SIGN IN/UP for ITR filing

02

Step 2: ADD BASIC DETAILS AS PER YOUR PAN for ITR FILING

03

Step 3: SELECT YOUR NATURE OF INCOME

04

Step 4: SUBMIT YOUR ITR FILING ORDER

05

Step 5: OUR EXECUTIVE WILL CONTACT YOU FOR ITR FILING

06

Step 6: ITR FILING BY CA AFTER DISCUSSION WITH YOU

- 98% Customer satisfaction

- ₹ 2400 Crore + Loan Approved

Project report for bank loan

Get your project report generated from CA's and Finance Experts

- Prepared After Discussion

- Open to Modifications

- Acceptable by Banks

- Affordable

- Easy

- Hassle Free

Benefits

Why should You file ITR

Filing your ITR ensures legal compliance and financial transparency. Here are the reasons and benefits of filing ITR:

INCOME TAX REFUND

Shops and Business can get their TDS back into their Bank account. File Business ITR with Finance Suvidha Kendra and get maximum Income Tax Refund.

VISA PURPOSE

Embassies and Immigration consultant demands 3 years Business Income Tax Return. File 3 years Business ITR with Finance Suvidha Kendra

LOAN APPLICATION

Banks demands 3 years Business Income Tax Return to process Loan Applications . File 3 years Business ITR with Finance Suvidha Kendra

INCOME PROOF

Business ITR act as proof of your Income. which can be used in Insurance claims, buying High Value Properties etc. File Business ITR with Finance Suvidha Kendra

TAX COMPLIANCE

As per Income Tax Rules if your annual Income is more than ₹ 2,50,000/- , Shops and Business are required to file their Income Tax Return. File Business return with Finance Suvidha Kendra

Are you looking for Income Tax Refund ?

Tax Experts and CA's of Finance Suvidha Kendra can help you in getting maximum REFUND OF TDS. We have helped more than 1,50,000 clients to get TDS refund of more than Rs 400 Crores.

We Keep Your Data Secured

FSK India employ robust security measures to ensure that your data is safeguarded, providing you with the peace of mind you deserve.

India is Loving Us:

No. of ITR Filed

Income Tax Refund Claimed

No of Project Report for Bank Loan Created

Authorised By Income Tax Department

Rest assured, ITR services at Finance Suvidha Kendra are authorized by the Income Tax Department, ensuring transparency, credibility, and compliance with the highest standards for your financial peace of mind.

Benefits of E-Filing ITR from

Finance Suvidha Kendra

Easiest and Lowest Cost ITR filing App in India

Finance Suvidha Kendra is super easy to use. Users can get their ITR Filing in few clicks. There is no need of Income Tax knowledge required. Our Income Tax experts will file ITR for you. ITR pricing AT Finance Suvidha Kendra starting at as low as Rs 399/- (Incl GST)

ITR Filing by CA and Income Tax Experts

User have to provide their basic details only. Our team of CA's and Income Tax experts will call you to discuss for ITR Filing. As the Income Tax Return is filed by team of CA's and Income Tax experts user can trust the work quality.

Best Customer Care and Support Service

Finance Suvidha Kendra have dedicated team to always help you in submitting order for E-filing Income Tax return and handling any queries you may have. Our support team will guide you on each and every step.

Frequently Asked Questions

Finance Suvidha Kendra Income Tax Return Services: Frequently Asked Questions (FAQs)

As per Income Tax Act, if you are a Indian Resident and your Income is upto Rs 7,00,000/- then there is no Income Tax applicable to you.

You need to file Income Tax Return in prescribed format. After E-filing income tax return the Income Tax Department will process the same and your refund will be credited in your Bank account. Click here to claim your Refund Now.

You can quickly file your tax return from Finance Suvidha Kendra's App in very few simple steps. You don't need any knowledge of Income Tax. Our experts are there for you always. Your Income Tax Return will be e-filed by our Tax experts.

We have team of CA's and Tax experts with over 15 years of experience. Our dedicated experts prepare your ITR with applicable laws to ensure that you save maximum tax and get maximum TDS refund.

Yes, Finance Suvidha Kendra is authorised E-return intermediary(ERI) of Income Tax Department.

It is dependent on Income Tax Department. In normal cases the Income Tax Department credit Income Tax Refund in 3 to 7 days. However in complex cases it may take upto 3 to 6 months.

Get in touch with our Tax Experts to help you get your refund Faster.

Yes, Zomato/ Swiggy deduct the 1% Tax from your Partner Payout. For example if ZOMATO/SWIGGY pay you Rs 10000/- they will deduct Rs 100/- TDS and credit Rs 9900/- in your Bank Account.

On an average Rs 2000-2500/- TDS is deducted every year of Delivery Rider. Are you loosing the TDS every year by not e-filling Income Tax Return?

Yes, OLA/UBER/RAPIDO deduct the 1% Tax from your Partner Payout. For example if OLA/UBER/RAPIDO pay you Rs 10000/- they will deduct Rs 100/- TDS and credit Rs 9900/- in your Bank Account.

On an average Rs 3000-5000/- TDS is deducted every year of Taxi Driver. Are you loosing the TDS every year by not e-filling Income Tax Return?

As per Income Tax Act, if you are having Income above Rs 2,50,000/- then you are liable to file Income Tax Return u/s 139 of Income Tax Act.

There are many benefits of E-filling Income Tax Return some of which are listed below:

- Legal Compliance

- Income Documentation

- Loan and Visa Applications

- Claiming Refunds

and many more..