BEST SALARY INCOME TAX RETURN FILING BY CA

Get Salaried ITR filed by CA for Private, Corporate and Government Employees and Pension Holders . Claim Maximum Tax Refund of TDS on Salary with FSKIndia

अब CA द्वारा INCOME TAX RETURN फाइल करें आसानी से

Our CA are Experts For filing Income Tax Return (Salary Person) after discussing your Income details with you on phone.

Benefits For Filing Income Tax Return Salaried Person From FSKIndia

Why should Salaried Employee file ITR Online

Filing your Income TAX Return Salary is mandatory if your annual Income exceeds Rs 2,50,000/-. Moreover, there is no Tax on Income upto Rs 7.00,000/-.

Claim Income Tax Return Salary

Salaried Person can get their TDS back into their Bank account. File Salary ITR with Finance Suvidha Kendra and get maximum Income Tax Refund.

SALARY ITR - VISA PURPOSE

Embassies and Immigration consultant demands 3 years Salary Income Tax Return. Get last 3 years Salary ITR filed by CA with Finance Suvidha Kendra.

SALARY ITR - LOAN APPLICATION

Banks demands 3 years Salary Income Tax Return to process Loan Applications . File 3 years Salary ITR with Finance Suvidha Kendra

INCOME PROOF

Salaried ITR act as proof of your Income. which can be used in Insurance claims, buying High Value Properties etc. File Business ITR with Finance Suvidha Kendra

TAX COMPLIANCE

As per Income Tax Rules if your annual Income is more than ₹ 2,50,000/- , Salaried Employees are required to file their Income Tax Return. Get Salaried Income Tax return file by CA with Finance Suvidha Kendra

Is it possible for me to submit my Income TAX Return Salary for the last 3 years

With FSKIndia you can file your Income Tax Return of Salaried and Pension upto 3 Years altogether.

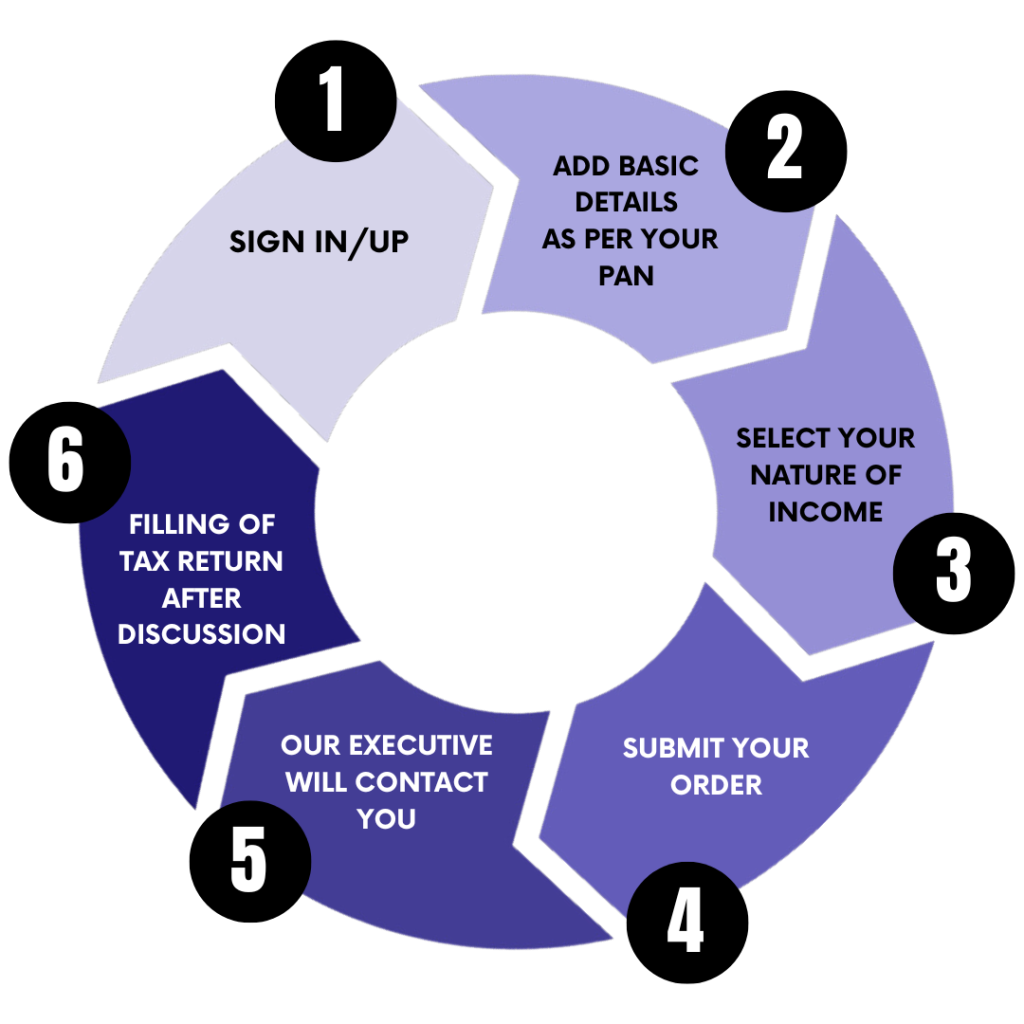

Steps of Filing your Income Tax Return Salary

6 Simple Steps for Income Tax Return Salary E-filing by Tax Experts

01

Step 1: SIGN In/Up at FSKIndia app

02

Step 2: ADD BASIC DETAILS AS PER YOUR PAN for ITR FILING

03

Step 3: SELECT YOUR NATURE OF INCOME

04

Step 4: SUBMIT YOUR ITR FILING ORDER

05

Step 5: OUR EXECUTIVE WILL CONTACT YOU FOR ITR FILING

06

Step 6: ITR FILING BY CA AFTER DISCUSSION WITH YOU

Frequently Asked Questions On Income Tax Return Salaried

Finance Suvidha Kendra Income Tax Return Services For: Salaried Employees

As per Income Tax rules, Every Salaried person, Pension holders and all those who earn more than Rs 250000/- in a year are required to file their Income Tax Return. Non -filing of Income Tax Return may attract notice from Income Tax Department.

Income Tax Return for Salary can be filed by following easy steps.

- Sign in into Finance Suvidha Kendra App.

- Add your basic details as per PAN

- Select Your Nature of Income as Salaried Employee

- Submit Your Order

- Finance Suvidha Kendra Executive will call You

- Income Tax Return Filing by CA after discussion with Salaried Employee

Yes, to apply for all types on Loan you need ITR-Income Tax Return. Tax experts and CA's at FSK India File Income Tax Return according to requirments of Banks.

Yes, to apply for all types on Visa Application you need ITR-Income Tax Return. Tax experts and CA's at FSK India File Income Tax Return according to requirements of Immigration departments.

Don't worry our Tax experts are always here for you. You have to provide only basic details and rest of the work will be done by our Tax Experts only. Your Salaried ITR will be filed our CA's and Tax Experts

As per Income Tax guidelines no Tax is applicable in A.Y. 2024-25 upto Income of Rs 700000/-. If your Income is upto Rs 700000/- you can get full refund of the TAX deducted. for more details about your tax calculation use our simple and easy Tax Calculator

It is dependent on Income Tax Department. In normal cases the Income Tax Department credit Income Tax Refund in 3 to 7 days. However in complex cases it may take upto 3 to 6 months.

Is your Income Tax refund stuck?

Get in touch with our Tax Experts to help you get your refund Faster.

You need to provide only basic details and documents to us as mentioned below:

- PAN Card

- Aadhaar Card

- Bank account details

All the remaining details will be collected by our Tax experts on call.

Contact Us

Love to Hear from You, Get In Touch

We're here to assist you every step of the way.

- (0175) 5031685

- FSK.BBMS@GMAIL.COM

- 1070/2, B.H. COMPLEX , TRIPURI , PATIALA-147001.

Get Call Back From TAX Experts!

Fill out the form below, and we will be in touch shortly.

- This Offer Is Available for all CSC Centers And Internet cafe's

Latest Offer! File Your First ITR at Just ₹1/- Only...

- FLAT 50% OFF for Retailers Self ITR