SWIGGY/ZOMATO/BLINKIT FOOD DELIVERY PARTNERS

Tax Refund for Swiggy & Zomato Delivery Partners

Now Swiggy & Zomato Delivery Partners can quickly get Income Tax Refund by ITR Filing through CA @ just ₹ 199/- TAX Refund for Swiggy & Zomato Delivery Partners

अब CA द्वारा INCOME TAX RETURN फाइल करें आसानी से

Our CA will file your Income Tax Return after discussing your Income details with you on phone.

More Than10,000+ Zomato Delivery Partners got Income Tax Refund

More Than10,000+ Zomato Delivery Partners got Income Tax Refund

Rohit Mishra

Zomato Delivery Partner from Patna!

- Finance Suvidha Kendra se ITR file krke mera Income Tax just 7 days mei mere account mei refund aagya. Process bht hi simple aur affordable hai.

Tax Refund of more than₹ 50 CroreReceived by Swiggy Delivery Partners

Tax Refund of more than₹ 50 CroreReceived by Swiggy Delivery Partners

Abhay Mehra

Swiggy Delivery Partner from Pune

- Maine Finance Suvidha Kendra se easy ITR Filing ka process kahi ni dekha. It is super easy and Support team bahut helpful hai.

98%Zomato Delivery Partners Repeat Income Tax Return Filing with Us

98%Zomato Delivery Partners Repeat Income Tax Return Filing with Us

Simran Singh

Zomato Delivery Partner from Jalndhar!

-

Finance Suvidha Kendra ki app se ITR file krna bahut assaan hai. Just 5 minute mei apna Tax Refund apply krdiya aur 15 days mei mera TDS refund agya.

Thank you Finance Suvidha Kendra!

Average Income Tax Refund of ₹ 2,250/- received by Swiggy Delivery Partners

Average Income Tax Refund of ₹ 2,250/- received by Swiggy Delivery Partners

Aadil Kashyap!

Swiggy Delivery Partner from Bangalore!

- Filing ITR through Finance Suvidha Kendra is very convenient. I didn't have to submit any documents to claim my Income Tax Refund. Received my Tax refund in Just 12 days.

How Much Tax Refund Swiggy & Zomato Delivery Partners can Get?

Food Delivery Service Companies Deducts 1 % Tax From Your Payouts. Now Get Tax Refund Swiggy & Zomato Delivery Partners.

For Example: Tax Refund Swiggy & Zomato

If Swiggy And Zomato Delivery Partners Annual Payout is Rs 3,50,000 then yourTDS @ 1 % will be Rs 3500/-

Annual Payout

₹1,00,000/-

₹2,50,000/-

₹4,00,000/-

Deducted TAX

₹1,000/-

₹2,500/-

₹4,000/-

TDS Calculator For Tax Refund Zomato & Swiggy

Enter your Payout to find out the amount of TDS deducted by Zomato & Swiggy

Want to Get Refund of the TDS ?

Click on the button below and File your Income Tax Return Our team of Tax Experts will file your ITR and get your Tax refund in your Bank Account

TAX REFUND Swiggy And Zomato Delivery Partners NOW

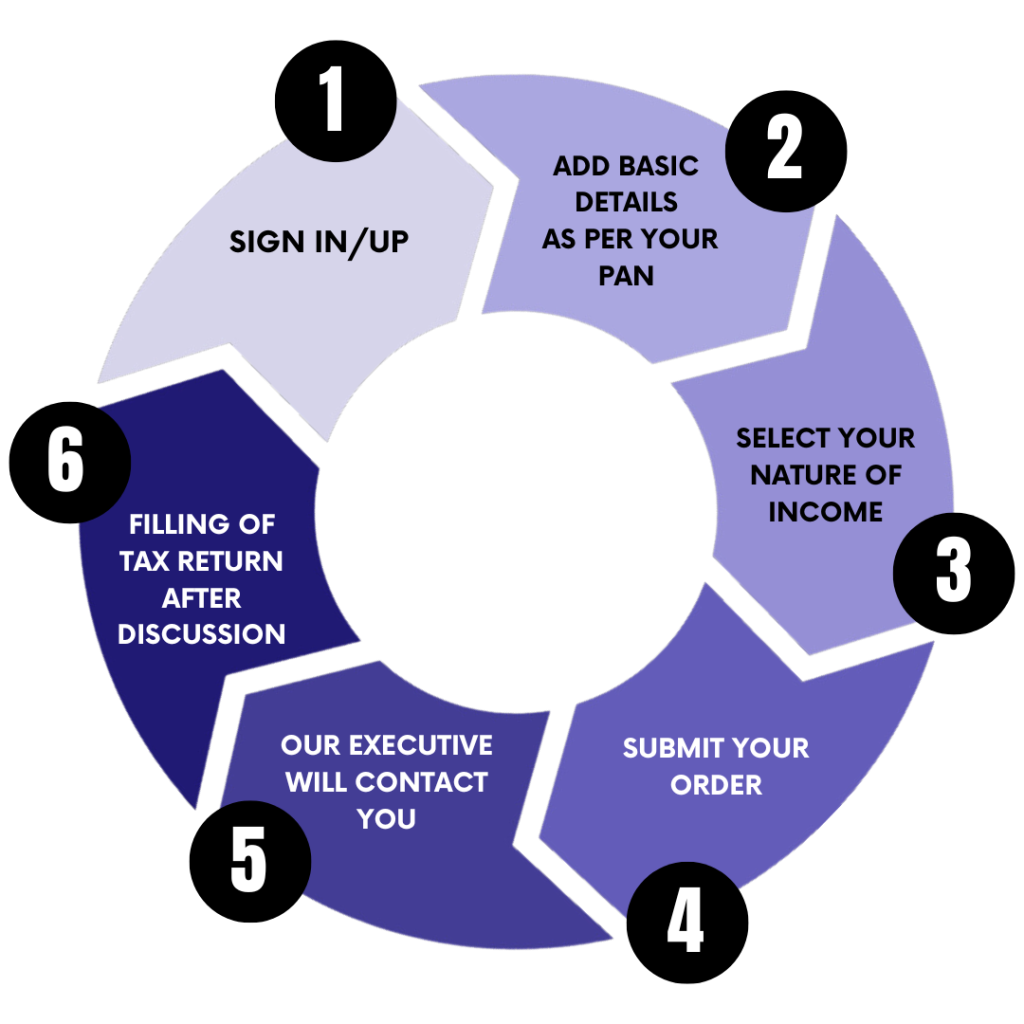

6 Simple Steps to E-File your Income Tax Return

01

Step 1: SIGN IN/UP for ITR filing

02

Step 2: ADD BASIC DETAILS AS PER YOUR PAN for ITR FILING

03

Step 3: SELECT YOUR NATURE OF INCOME

04

Step 4: SUBMIT YOUR ITR FILING ORDER

05

Step 5: OUR EXECUTIVE WILL CONTACT YOU FOR ITR FILING

06

Step 6: ITR FILING BY CA AFTER DISCUSSION WITH YOU

Provide only PAN- Aadhaar details, Other details will be discussed by CA & Tax Experts on PHONE

Claim TAX REFUND for Swiggy and Zomato Delivery Partners by Filing ITR Online.

Benefits Of Filing itr for Swiggy And Zomato Delivery Partners

Why should Swiggy and Zomato Delivery Partners file ITR

Filing your ITR ensures legal compliance and financial transparency. Here are the reasons and benefits of filing ITR:

TAX REFUND SWIGGY AND ZOMATO

File ITR Online and Get TAX Refund for Swiggy and Zomato Delivery Partners in Bank Account. File ITR with Finance Suvidha Kendra and get maximum Income Tax Refund.

VISA PURPOSE

Embassies and Immigration consultant demands 3 years Business Income Tax Return. File 3 years Business ITR with Finance Suvidha Kendra

LOAN APPLICATION

Banks demands 3 years Business Income Tax Return to process Loan Applications . File 3 years Business ITR with Finance Suvidha Kendra

INCOME PROOF

Business ITR act as proof of your Income. which can be used in Insurance claims, buying High Value Properties etc. File Business ITR with Finance Suvidha Kendra

TAX COMPLIANCE

As per Income Tax Rules if your annual Income is more than ₹ 2,50,000/- , Swiggy and Zomato Delivery Partners are required to file their Income Tax Return. File Business return with Finance Suvidha Kendra

Frequently Asked Questions On Tax Refund Swiggy & Zomato Delivery Partners

Finance Suvidha Kendra Income Tax Return Services : TAX REFUND for Swiggy And Zomato Delivery Partners.

Zomato/ Swiggy deducts 1% TDS from their delivery rider's Payout. For example If their Payout is Rs 100000/- then Tax deducted by Zomato/ Swiggy will be Rs 1000/-

Yes, Rider can claim Tax Refund by filling their Income Tax Return once in a year. File Tax Return at FSK India only at price of ………..

INCOME TAX REFUND FOR Swiggy and Zomato Delivery Partners can be claimed by following easy steps.

- Sign in into Finance Suvidha Kendra App.

- Add your basic details as per PAN

- Select Your Nature of Income as Swiggy and Zomato Delivery Partners

- Submit Your Order

- Finance Suvidha Kendra Executive will call You

- Income Tax Return Filing by CA after discussion with Swiggy and Zomato Delivery Partners.

Yes, you can check your Tax by providing basic details here. Click here to check TDS for FREE

We have team of CA's and Tax experts with over 15 years of experience. Our dedicated experts prepare your ITR with applicable laws to ensure that you save maximum tax and get maximum TDS refund.

Yes, Finance Suvidha Kendra is authorised E-return intermediary(ERI) of Income Tax Department.

It is dependent on Income Tax Department. In normal cases the Income Tax Department credit Income Tax Refund in 3 to 7 days. However in complex cases it may take upto 3 to 6 months.

Is your Income Tax refund stuck?

Get in touch with our Tax Experts to help you get your refund Faster.

Get in touch with our Tax Experts to help you get your refund Faster.

Contact Us

Love to Hear from You, Get In Touch

We're here to assist you every step of the way.

- (0175) 5031685

- FSK.BBMS@GMAIL.COM

- 1070/2, B.H. COMPLEX , TRIPURI , PATIALA-147001.