Home

/

Zomato / Swiggy Executive

Tax Refund for E-KART DELIVERY PARTNERS

Tax Refund for E-Kart Delivery Partners

E-Kart Delivery Partners can now get Income Tax Refund by ITR Filing through CA for just ₹399/- TAX Refund for E-Kart Delivery Partners

अब CA द्वारा INCOME TAX RETURN फाइल करें आसानी से

Our CA Experts will prepare your Income Tax Return once your income details have been discussed with him over the phone.

Easy & Simple Process ToFile Tax Refund For E-KartNot Any Document Required!

Easy & Simple Process ToFile Tax Refund For E-KartNot Any Document Required!

Vikas Jaiswal

E-Kart Delivery Partner From Mumbai.

- Finance Suvidha Kendra ki app ka istemal karke mere liye tax refund pane mein kaafi aasan ho gayi. Mene bas apne PAN aur Aadhaar ke details se refund ke liye apply kiya, aur kisi bhi document ko upload karne ki zarurat nahi pdi.

Average Income Tax Refund ₹ 5,250/-Received By E-Kart Delivery Partner

Average Income Tax Refund ₹ 5,250/-Received By E-Kart Delivery Partner

Rakesh Joshi

E-Kart Delivery Partner From Punjab.

- ainne pahle kabhi itni aasan aur affordable sarvis ka Use nahi kiya hai. Finance Suvidha Kendra ke help se Income tax riturn file karana mere liye bs 5 minat ka kam tha.

FSK India Is Leading With More Than1,500+E-Kart Delivery Partners Received Income Tax Refund

FSK India Is Leading With More Than15,000+E-Kart Delivery Partners Received Income Tax Refund

Sushil Sharma

E-Kart Delivery Partner From Lucknow.

- Only two Weeks ke andar, meri Income Tax Refund mere bank account wapas agya Finance Suvidha Kendra ki Help se. Thank You! Finance Suidha Kendra

Easy & Simple Process ToFile Tax Refund For E-KartNot Any Document Required!

Easy & Simple Process ToFile Tax Refund For E-KartNot Any Document Required!

Vikas Jaiswal

E-Kart Delivery Partner From Mumbai.

- Finance Suvidha Kendra ki app ka istemal karke mere liye tax refund pane mein kaafi aasan ho gayi. Mene bas apne PAN aur Aadhaar ke details se refund ke liye apply kiya, aur kisi bhi document ko upload karne ki zarurat nahi pdi.

Average Income Tax Refund ₹ 5,250/-Received By E-Kart Delivery Partner

Average Income Tax Refund ₹ 5,250/-Received By E-Kart Delivery Partner

Rakesh Joshi

E-Kart Delivery Partner From Punjab.

- ainne pahle kabhi itni aasan aur affordable sarvis ka Use nahi kiya hai. Finance Suvidha Kendra ke help se Income tax riturn file karana mere liye bs 5 minat ka kam tha.

FSK India Is Leading With More Than1,500+E-Kart Delivery Partners Received Income Tax Refund

FSK India Is Leading With More Than15,000+E-Kart Delivery Partners Received Income Tax Refund

Sushil Sharma

E-Kart Delivery Partner From Lucknow.

- Only two Weeks ke andar, meri Income Tax Refund mere bank account wapas agya Finance Suvidha Kendra ki Help se. Thank You! Finance Suidha Kendra

How Much Tax Refund for E-KART Delivery Partners can Get?

You can now get a refund for your taxes if you are a E-Kart Delivery Partners.

For Example: Tax Refund For E-KART

if E-Kart Delivery Partners makes an annual payout of ₹3,50,000.TDS at 1% will be ₹3500/-

Annual Payout

₹1,00,000/-

₹2,50,000/-

₹4,00,000/-

Deducted TAX

₹1,000/-

₹2,500/-

₹4,000/-

TDS Calculator - For Tax Refund for E-KART

Calculate Your TDS Deducted for Tax Refund E-Kart

Want to Get Refund of the TDS ?

Click on the button below and File your Income Tax Return Our team of Tax Experts will file your ITR and get Tax refund of E-Kart Delivery Partners in Bank Account

TAX REFUND for E-Kart Delivery Partners

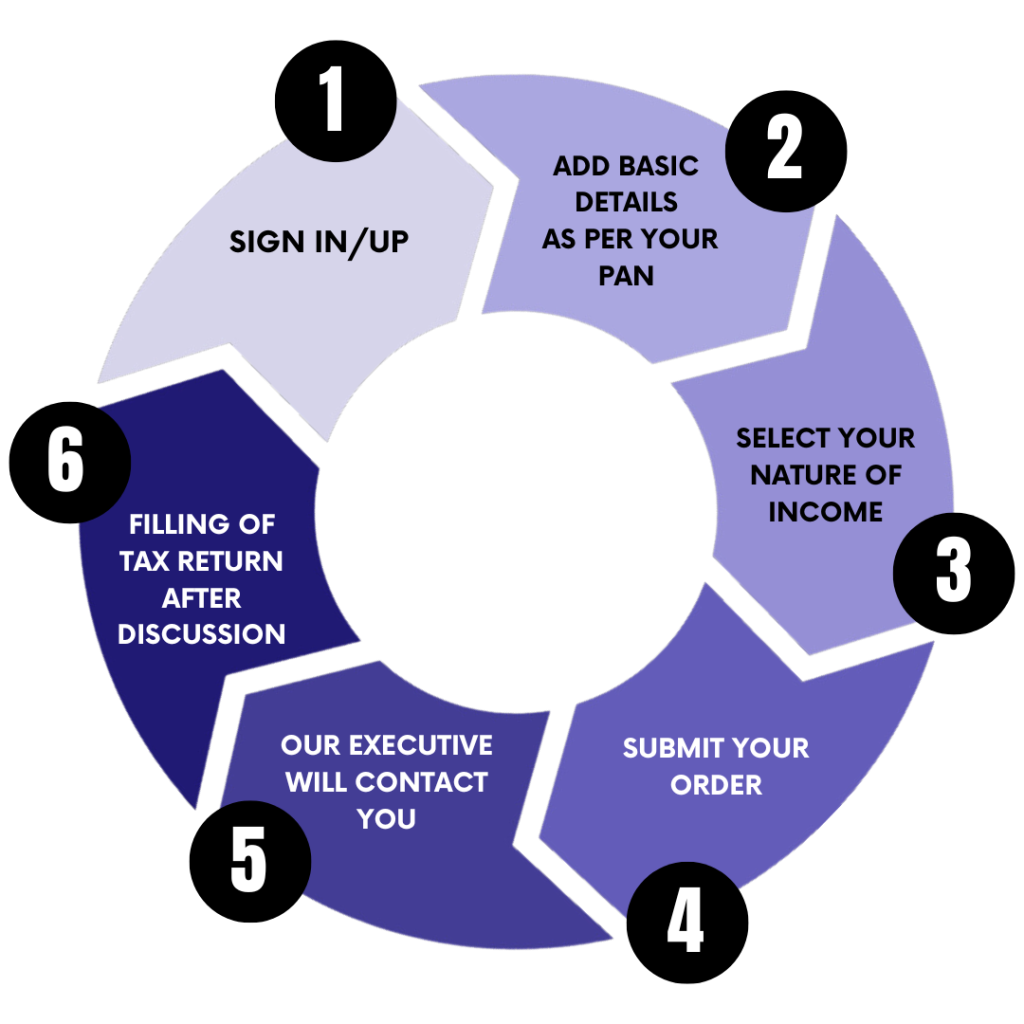

6 Simple Steps to E-File Income Tax Refund for E-kart Delivery Partners

01

Step 1: SIGN IN/UP for ITR filing

02

Step 2: ADD BASIC DETAILS AS PER YOUR PAN for ITR FILING

03

Step 3: SELECT YOUR NATURE OF INCOME

04

Step 4: SUBMIT YOUR ITR FILING ORDER

05

Step 5: OUR EXECUTIVE WILL CONTACT YOU FOR ITR FILING

06

Step 6: ITR FILING BY CA AFTER DISCUSSION WITH YOU

Provide only PAN- Aadhaar details, Other details will be discussed by CA & Tax Experts on PHONE

Claim TAX REFUND for E-Kart Delivery Partners by Filing ITR Online.

Benefits Of Filing itr for E-Kart Delivery Partners

What is the purpose of E-Kart Delivery Partners filing an ITR?

In addition to ensuring legal compliance and financial transparency, filing an ITR has the following benefits:

TAX REFUND FOR E-KART

Get your Income Tax Refund for E-Kart Delivery Partners in your bank account by filing your ITR online From Finance Suvidha Kendra.

VISA PURPOSE

Embassies and immigration consultants require 3 years of Business Income Tax Returns. File these with the Suvidha Kendra of the Ministry of Finance.

LOAN APPLICATION

To process Loan Applications, banks require 3 years of Business Income Tax Returns. File 3 years' Business Income Tax Returns with the Finance Suvidha Kendra.

INCOME PROOF

It can be used for insurance claims, purchasing high value properties, etc. File the Business ITR with Finance Suvidha Kendra.

TAX COMPLIANCE

You are required to file your income tax return if your annual income exceeds ₹2,50,000/-. So file your return From Finance Suvidha Kendra.

Frequently Asked Questions On Tax Refund For E-Kart Delivery Partners

Finance Suvidha Kendra Income Tax Return Services : TAX REFUND for E-Kart Delivery Partners.

E-Kart deducts 1% TDS from the delivery riders' payouts. For instance, if a rider's payout is Rs 100,000, E-Kart will deduct Rs 1,000 as tax.

Yes, Rider can claim Tax Refund by filling their Income Tax Return once in a year. File Tax Return at FSK India only at price of ₹399/-

INCOME TAX REFUND FOR E-Kart Delivery Partners can be claimed by following easy steps.

- Sign in into Finance Suvidha Kendra App.

- Add your basic details as per PAN

- Select Your Nature of Income as E-Kart Delivery Partners

- Submit Your Order

- Finance Suvidha Kendra Executive will call You

- Income Tax Return Filing by CA after discussion with E-Kart Delivery Partners.

Yes, you can check your Tax by providing basic details here. Click here to check TDS for FREE

We have team of CA's and Tax experts with over 15 years of experience. Our dedicated experts prepare your ITR with applicable laws to ensure that you save maximum tax and get maximum TDS refund.

Yes, Finance Suvidha Kendra is authorised E-return intermediary(ERI) of Income Tax Department.

It is dependent on Income Tax Department. In normal cases the Income Tax Department credit Income Tax Refund in 3 to 7 days. However in complex cases it may take upto 3 to 6 months.

Is your Income Tax refund stuck?

Get in touch with our Tax Experts to help you get your refund Faster.

Get in touch with our Tax Experts to help you get your refund Faster.

Contact Us

Love to Hear from You, Get In Touch

We're here to assist you every step of the way.

- (0175) 5031685

- FSK.BBMS@GMAIL.COM

- 1070/2, B.H. COMPLEX , TRIPURI , PATIALA-147001.