File Business Income TAX Return

@ just ₹ 499/-

ITR FOR BUSINESS INCOME & SMALL SHOPS!

- File ITR online for the last 3 years for businesses, shops, restaurants, and offices.

- Assisted by CA and tax experts.

- Mandatory if annual income exceeds ₹2,50,000.

- No income tax on annual income up to ₹7,00,000.

अब CA द्वारा आसानी से फाइल करें INCOME TAX RETURN...

Benefits of Filing ITR FOR BUSINESS INCOME & SMALL SHOPS with FSKiNDIA

Why You File ITR For Business Income & Small Shops?

Filing your ITR is mandatory if your annual Income exceeds Rs 2,50,000/-. There is no Income Tax on Annual Income of Rs 7,00,000/- Other Benefits of Filing ITR For Business Income & Small Shops are mentioned below:

Claim INCOME TAX REFUND

Shops and Business can get their TDS back into their Bank account. File Business ITR with Finance Suvidha Kendra and get maximum Income Tax Refund.

VISA PURPOSE

Embassies and Immigration consultant demands 3 years Business Income Tax Return. File 3 years Business ITR with Finance Suvidha Kendra

LOAN APPLICATION

Banks demands 3 years Business Income Tax Return to process Loan Applications . File 3 years Business ITR with Finance Suvidha Kendra

INCOME PROOF

Business ITR act as proof of your Income. which can be used in Insurance claims, buying High Value Properties etc. File Business ITR with Finance Suvidha Kendra

TAX COMPLIANCE

As per Income Tax Rules if your annual Income is more than ₹ 2,50,000/- , Shops and Business are required to file their Income Tax Return. File Business return with Finance Suvidha Kendra

Cash deposit Income Tax

Business ITR act as proof of your Income. which can be used in Insurance claims, buying High Value Properties etc. File Business ITR with Finance Suvidha Kendra

ITR For Business Income & Small Shops

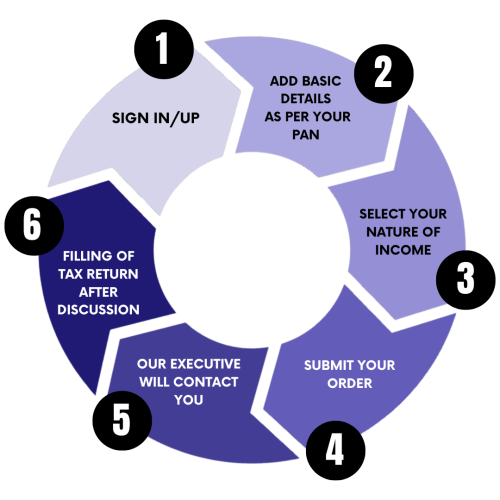

3 Simple Steps to E-File your ITR For Business Income & Small Shops!

Provide Your Basic PAN Details.

File ITR & Get Your TDS Refund To Your Bank Account.

What Is ITR for Business?

ITR for Business refers to the Income Tax Return filed by individuals, professionals, firms, or companies reporting their income earned through business activities. Any income generated from trading, manufacturing, providing services, consultancy, or other commercial operations falls under business income and must be declared in the appropriate ITR form.

ITR Form for Business Income

Filing Income Tax Returns (ITR) is essential for individuals and entities with business income. Business income can be derived from various sources, such as trading, manufacturing, services, consultancy, or even activities like Futures and Options (F&O) trading. It is crucial to select the correct ITR form based on the type and scale of the business to comply with the Income Tax Department’s regulations.

Which ITR to File for Business Income?

The selection of the appropriate ITR form depends on the nature of the business income, turnover, and whether the accounts are audited under Section 44AB of the Income Tax Act. Here’s a breakdown:

1. ITR-3

Who should file?

Individuals or Hindu Undivided Families (HUFs) earning income from a proprietorship business or profession.

Applicable for:

- Income from trading, manufacturing, or services.

- Income from Futures and Options (F&O) trading.

- Any other business income not covered under presumptive taxation.

2. ITR-4 (Sugam)

Who should file?

Individuals, HUFs, or Firms (other than LLPs) opting for presumptive taxation under Section 44AD, 44ADA, or 44AE.

Applicable for:

- Small businesses with turnover up to ₹2 crores under Section 44AD.

- Professionals (doctors, architects, consultants, etc.) with gross receipts up to ₹50 lakhs under Section 44ADA.

- Businesses like goods transportation under Section 44AE.

Simplified Process: ITR-4 requires minimal data entry, focusing mainly on gross receipts, turnover, and presumptive income percentage.

3. ITR-5 & ITR-6

Who should file?

Partnership firms, LLPs, or companies.

Applicable for:

- Firms or LLPs operating a business.

- Companies generating business income (ITR-6 applies to companies not claiming exemption under Section 11).

F&O Business Code in ITR

When filing ITR for Futures and Options (F&O) trading, you need to provide a business code that accurately reflects your trading activities. The business code for F&O trading falls under the trading category in the ITR form.

F&O Business Code:

- The business code for F&O trading is 09028 (Other financial activities).

- Mention this code while reporting income or loss from F&O trading in the “Business and Profession” schedule of the ITR form.

Important Points to Consider:

1. Tax Audit Requirements:

If the total turnover exceeds ₹10 crores (in case of digital transactions) or ₹1 crore (for cash transactions), a tax audit is required under Section 44AB. For F&O trading, turnover includes the total of favorable and unfavorable differences.

2. Books of Accounts:

- Businesses with significant income or turnover must maintain proper books of accounts.

- Small businesses filing under presumptive taxation are exempt from this requirement.

3. Losses in F&O Trading:

Losses incurred in F&O trading can be set off against other income heads (except salary) and carried forward for up to 8 years if properly reported.

4. GST Applicability:

For businesses providing goods or services, ensure GST compliance if turnover exceeds ₹20 lakhs (₹10 lakhs in some states for services).

Need Help Filing Your ITR for Business Income?

At Finance Suvidha Kendra, we provide ITR filing services for business income with expert guidance. Whether you’re a trader, small business owner, or professional, we ensure accurate filing, maximize deductions, and help you stay compliant.

- Download our App for hassle-free ITR filing.

- Contact us for expert advice today!

Can I File Last Three Year ITR For Business Income?

With FSK India you can file last 3 year ITR - Income Tax Return of Shop and Business altogether.

Frequently Asked Questions On ITR For Business Income & Small Shops

Finance Suvidha Kendra Income Tax Return For Business Income & Smalls Shops!

Who should file their Income Tax Return ?

As per Income Tax rules, Every Shop owner, Self employed, Offices , Free Lancers and all those who earn more than Rs 250000/- in a year are required to file their Income Tax RETURN.

Do a Shopkeeper , Self Employed or Business need GST Details for Income Tax Filling?

Only, Shopkeeper , Self Employed or Business who are registered under GST are required to submit their GST details while filling Income Tax Return.

Do Shops and Business need ITR-Income Tax Return for applying Bank Loan?

Yes, to apply for all types on Loan you need ITR-Income Tax Return. Tax experts and CA's at FSK India File Income Tax Return according to requirments of Banks.

Whether Shops and Business need ITR-Income Tax Return for Visa Application purpose?

Yes, to apply for all types on Visa Application you need ITR-Income Tax Return. Tax experts and CA's at FSK India File Income Tax Return according to requirements of Immigration departments.

As a Shop keeper and Businessman I don’t know how to file Income Tax Return , what can I do?

Don't worry our Tax experts are always here for you. To file ITR for Shop and Business you have to provide only basic details and rest of the work for ITR Filing Online will be done by CA and Tax Experts of FSK India.

How much Income Tax Refund a Shop and Business can get by E-filing ITR Online?

As per Income Tax guidelines no Tax is applicable up to Income of Rs 700000/-. If your Income is up to Rs 700000/- you can get full refund of the TAX deducted.

How much time it will take to credit Income Tax Refund in my Bank account after E-filing ITR Online?

It is dependent on Income Tax Department. In normal cases the Income Tax Department credit Income Tax Refund in 3 to 7 days. However in complex cases it may take up to 3 to 6 months.

Is your Income Tax refund stuck?

Get in touch with our Tax Experts to help you get your refund Faster.

What are the Document Required for Shop and Business ITR Filing or Claiming Income Tax Refund?

Shop and Business need to provide only basic details and documents to Finance Suvidha Kendra for ITR Filing as mentioned below:

- PAN Card

- Aadhaar Card

- Bank account details

All the remaining details will be discussed by CA's and Tax experts of FSK India on call.