How To Get Zomato TDS Refund | FSK India

How a Zomato Delivery Partner can get Tax Refund?

If you are a Zomato Delivery Partner and wonder why the amount you received in Bank from Zomato is always than the amount you earned by delivering all the yummy dishes to the customer?

We have got the answer for you. The payment a Zomato Delivery Partner receive from Zomato for delivering food is after Tax Deduction (TDS).

How Much TDS is deducted by Zomato from payout of Zomato Delivery Partner’s Payout ?

The Income Tax Department have made it mandatory to the Zomato like companies to deduct 1% TDS from the payout of Zomato Delivery Partners.

For Example if the Payout of Zomato Delivery Partners is Rs 100000/- then TDS will be Rs 1000/-

To know how much TDS is deducted by Zomato Use our very easy and simple TDS calculator.

How Zomato Delivery Partners can get the Tax Tax Refund of the TDS deducted by Zomato?

The process of getting the Tax Refund of TDS is very simple. Zomato Delivery Partners just have to file their Income Tax Returns (ITR) to get the Tax Refund of TDS into their Bank account.

Income Tax Return filing at Finance Suvidha Kendra is very easy, simple and affordable.

Zomato Delivery Partners can file their Income Tax Return at just Rs 199/-(Inc GST).

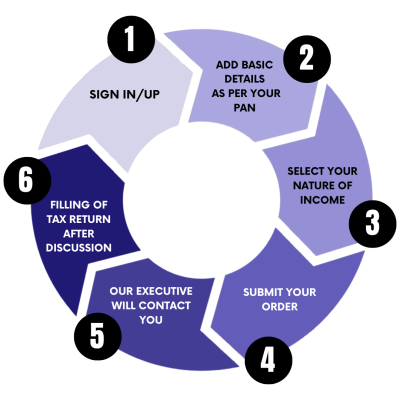

What is the process of filing Income Tax Return at Finance Suvidha Kendra for Zomato Delivery Partners ?

The process of filing Income Tax Return at Finance Suvidha Kendra for Zomato Delivery Partners is very simple Just follow the basic 6 steps below and get the TDS Tax Refund in your Bank account.

Steps For File Your ITR Now

3 Simple Steps to get ITR E-Filed after discussion with CA

File ITR & Get Your TDS Refund To Your Bank Account.

Any confusion about TAX Refund?

Talk to our Tax Experts and let them file your Income Tax Return

What document Zomato Delivery Partners needs to file Income Tax Returns to file Income Tax Return at Finance Suvidha Kendra ?

Zomato Delivery Partners needs only their

- PAN Card

- Aadhaar Card

- Bank account number and IFSC Code

All the other details will be taken by team of CA’s and Income Tax Experts at Finance Suvidha Kendra.

What are other benefits of filing Income Tax Return apart from Tax Refund for Zomato Delivery Partners?

INCOME TAX REFUND

Shops and Business can get their TDS back into their Bank account. File Business ITR with Finance Suvidha Kendra and get maximum Income Tax Refund.

VISA PURPOSE

Embassies and Immigration consultant demands 3 years Business Income Tax Return. File 3 years Business ITR with Finance Suvidha Kendra

LOAN APPLICATION

Banks demands 3 years Business Income Tax Return to process Loan Applications . File 3 years Business ITR with Finance Suvidha Kendra

INCOME PROOF

Business ITR act as proof of your Income. which can be used in Insurance claims, buying High Value Properties etc. File Business ITR with Finance Suvidha Kendra

TAX COMPLIANCE

As per Income Tax Rules if your annual Income is more than ₹ 2,50,000/- , Shops and Business are required to file their Income Tax Return. File Business return with Finance Suvidha Kendra

In how much time Tax Refund of TDS deducted by Zomato will be credit in Bank Account ?

The Income Tax Department process the ITR of Zomato Delivery Partners withing 7-10 working days. However, In some cases it may take longer time to get Tax Refund credited in bank account of Zomato Delivery Partners

I am Zomato Delivery Partners and does not know how to file Income Tax Return?

No need to worry, Finance Suvidha Kendra application is specially designed for Zomato Delivery Partners to file their Income Tax Return and claim their Tax Tax Refund.

Zomato Delivery Partners just have to submit its basic details and per their PAN and Aadhaar Card. All the other work will be done by team of CA’s and Income Tax Experts. It is our motive to provide you super easy experience to claim the Tax Tax Refund.

Conclusion - Zomato TDS Refund

In conclusion, Zomato Delivery Partners can easily get a tax refund for the TDS deducted from their payouts by filing their Income Tax Returns (ITR). By choosing Finance Suvidha Kendra, the process becomes straightforward, affordable, and efficient. With just a few simple steps, Zomato Delivery Partners can have their ITR filed by experienced CAs and receive their TDS refunds directly into their bank accounts. Beyond tax refunds, filing ITR also provides additional benefits like proof of income, visa applications, and loan processing.

At FSK India, our goal is to make tax filing hassle-free for Zomato Delivery Partners, ensuring they maximize their refunds and stay compliant with tax regulations. Let us handle the complexities so you can focus on delivering great service.

FAQ's - Zomato TDS Refund

How Much Commission Does Zomato Take?

ITR 1 is for individuals with income from salaries, pensions, or one house property, and agricultural income up to ₹5,000. ITR 2 is for individuals with income from capital gains, multiple house properties, or foreign income, and those having business income not covered under ITR 1.

How To Get Refund From Zomato?

To get a refund from Zomato, go to the "Orders" section in the app, select the relevant order, and click on "Support" or "Help." Describe your issue, and submit the request. Zomato's team will review it and process the refund if eligible. For TDS refund services, FSK India can assist you with smooth and efficient tax refunds.