Uber Driver TDS Refund | Easy Process | FSK India

How To UBER Driver Get Their TDS Refund?

UBER Drivers: Have you ever wondered why the amount you receive in your bank account from UBER is never the same amount you earned?

Here’s the answer. A driver receives his or her UBER payment after tax deduction (TDS).

How much TDS is deducted from UBER Drivers' payouts?

The Income Tax Department has ruled that UBER-like companies must deduct 1% TDS from UBER driver payouts.

TDS is Rs 1000 if an Uber driver is paid Rs 100000/-

You can use our TDS calculator to find out how much UBER deducts for TDS

How can Uber Driver TDS Refund by Filing ITR?

We make it very easy for you to process your TDS tax refund. When UBER Drivers file their Income Tax Returns (ITR), their TDS refunds will be deposited into their bank accounts.

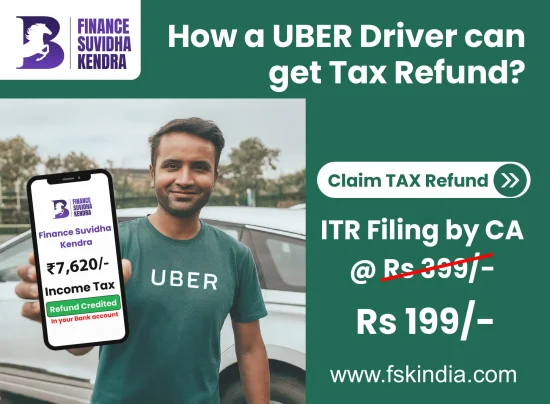

At Finance Suvidha Kendra, filing an income tax return is easy, straightforward, and affordable.

Drivers of UBER pay a fee of 199/- rupees (inclusive of GST) to file their income tax returns.

For Uber Driver TDS Refund file Their ITR at Finance Suvidha Kendra?

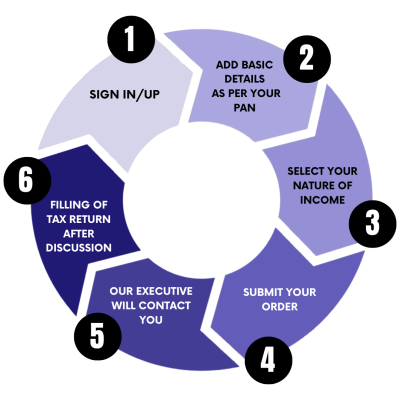

Simply follow the basic 3 steps below and get the TDS Tax Refund in your bank account after filing your Income Tax Return at Finance Suvidha Kendra for UBER Drivers.

Steps For File Your ITR Now

3 Simple Steps to get ITR E-Filed after discussion with CA

File ITR & Get Your TDS Refund To Your Bank Account.

Any confusion about TAX Refund?

Talk to our Tax Experts and let them file your Income Tax Return

What document needs for Uber Driver TDS Refund file ITR?

UBER Drivers needs only their:

- PAN Card

- Aadhaar Card

- Bank account number and IFSC Code

All the other details will be taken by team of CA’s and Income Tax Experts at Finance Suvidha Kendra.

In addition to receiving a tax refund, do UBER drivers receive any other benefits from filing their income tax returns?

INCOME TAX REFUND

Shops and Business can get their TDS back into their Bank account. File Business ITR with Finance Suvidha Kendra and get maximum Income Tax Refund.

VISA PURPOSE

Embassies and Immigration consultant demands 3 years Business Income Tax Return. File 3 years Business ITR with Finance Suvidha Kendra

LOAN APPLICATION

Banks demands 3 years Business Income Tax Return to process Loan Applications . File 3 years Business ITR with Finance Suvidha Kendra

INCOME PROOF

Business ITR act as proof of your Income. which can be used in Insurance claims, buying High Value Properties etc. File Business ITR with Finance Suvidha Kendra

TAX COMPLIANCE

As per Income Tax Rules if your annual Income is more than ₹ 2,50,000/- , Shops and Business are required to file their Income Tax Return. File Business return with Finance Suvidha Kendra

Frequently Asked Questions - Uber Driver TDS Refund

When will my bank account be credited with the Tax Refund of TDS deducted by Uber?

Income Tax Department processes UBER Drivers’ ITRs within 7-10 working days. In some cases, the Tax Refund will take longer to reach the bank account of UBER Drivers

If I am an Uber driver, how should I file my income tax return?

For filing income tax returns and claiming tax refunds, UBER Drivers can use the Finance Suvidha Kendra application.

It is only necessary for Uber drivers to submit their PAN and Aadhaar cards. A team of CAs and Income Tax Experts will handle other work. Getting your tax refund should be super easy with us.