How To Get Swiggy TDS Refund | FSK India

How a Swiggy Delivery Partner can get Tax Refund?

If you are a Swiggy delivery partner, you may be wondering why the money you get from Swiggy in your bank account never matches the money you make by serving customers delicious food.

We know the solution for you. After tax deduction (TDS), a Swiggy Delivery Partner receives paid from Swiggy for delivering meals.

How much TDS does Swiggy deduct from the Swiggy Delivery Partner's Payout?

The Income Tax Department requires that businesses similar to Swiggy deduct 1% TDS from Swiggy Delivery Partners’ payouts.

As an example, TDS will be Rs 1000 if Swiggy Delivery Partners get a payout of Rs 100000.

Use our highly user-friendly and easy-to-use TDS calculator to find out how much TDS is deducted by Swiggy.

How can Swiggy Delivery Partners get a tax refund for the TDS that Swiggy deducted?

Receiving a TDS tax refund is a very easy process. The only need for Swiggy Delivery Partners to get their bank account’s tax refund of TDS is to submit their Income Tax Returns (ITR).

The Finance Suvidha Kendra makes sending income tax returns very simple, cheap, and easy.

For only Rs 199/-(Inc GST), Swiggy Delivery Partners can submit their income tax returns.

How do Swiggy Delivery Partners file their income tax returns at Finance Suvidha Kendra?

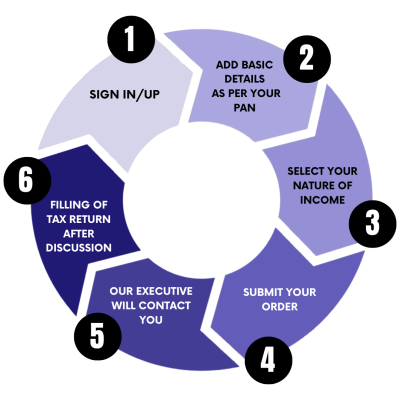

Simply follow the six fundamental steps listed below to file your income tax return at Finance Suvidha Kendra for Swiggy delivery partners and get your TDS tax refund in your bank account.

Steps For File Your ITR Now

3 Simple Steps to get ITR E-Filed after discussion with CA

File ITR & Get Your TDS Refund To Your Bank Account.

Any confusion about TAX Refund?

Talk to our Tax Experts and let them file your Income Tax Return

What paperwork is required for Swiggy Delivery Partners to submit income tax returns at Finance Suvidha Kendra?

Swiggy Delivery Partners needs only their:

- PAN Card

- Aadhaar Card

- Bank account number and IFSC Code

All the other details will be taken by team of CA’s and Income Tax Experts at Finance Suvidha Kendra.

In addition from the tax refund for Swiggy delivery partners, what additional advantages come with submitting an income tax return?

INCOME TAX REFUND

Shops and Business can get their TDS back into their Bank account. File Business ITR with Finance Suvidha Kendra and get maximum Income Tax Refund.

VISA PURPOSE

Embassies and Immigration consultant demands 3 years Business Income Tax Return. File 3 years Business ITR with Finance Suvidha Kendra

LOAN APPLICATION

Banks demands 3 years Business Income Tax Return to process Loan Applications . File 3 years Business ITR with Finance Suvidha Kendra

INCOME PROOF

Business ITR act as proof of your Income. which can be used in Insurance claims, buying High Value Properties etc. File Business ITR with Finance Suvidha Kendra

TAX COMPLIANCE

As per Income Tax Rules if your annual Income is more than ₹ 2,50,000/- , Shops and Business are required to file their Income Tax Return. File Business return with Finance Suvidha Kendra

How long would it take for the Tax Refund of TDS that Swiggy withdrew to be credited to the bank account?

Within seven to ten business days, the Income Tax Department processes the Swiggy Delivery Partners’ ITR. But sometimes, it could take longer for the Tax Refund to be deposited to Swiggy Delivery Partners’ bank accounts.

As a Swiggy Delivery Partner, am I unaware of the process for filing an income tax return?

Don’t worry; Swiggy Delivery Partners may submit their income tax returns and get their tax refunds by using the Finance Suvidha Kendra program, which was created just for them.

All that Swiggy Delivery Partners need to do is provide their PAN and Aadhaar Card data along with their basic details. A group of income tax experts and CAs will handle all other tasks. Our goal is to provide you an incredibly simple experience when claiming your tax refund.