OLA Driver TDS Refund | Easy Process | FSK India

How To OLA Driver Get Their TDS Refund?

OLA Drivers: Have you ever wondered why the amount you receive in your bank account from OLA is never the same amount you?

Here’s the answer. A driver receives his or her OLA payment after tax deduction (TDS).

How Much Amount Deducted From OLA Drivers Payouts?

OLA-like companies are required to deduct 1% TDS from the payout of OLA drivers under a ruling from the Income Tax Department.

If an OLA Driver is paid Rs 100000/-, then TDS is Rs 1000/-

You can use our very easy and simple TDS calculator to find out how much TDS OLA deducts.

Where Can OLA Driver TDS Refund?

For OLA Driver TDS Refund, TDS Tax Refunds are very easy to process. Tax Refunds of TDS will be deposited into the bank accounts of OLA Drivers as soon as they file their Income Tax Returns (ITR).

The process of filing an income tax return at Finance Suvidha Kendra is very straightforward, simple, and affordable.

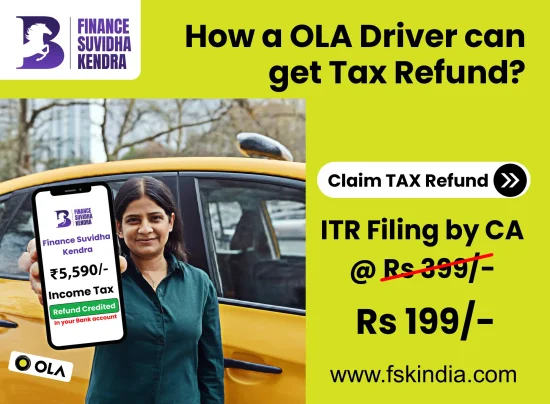

The filing fee for OLA Drivers’ Income Tax Returns is Rs 199 (includes GST).

What is the process of File ITR at FSK India For OLA Driver TDS Refund?

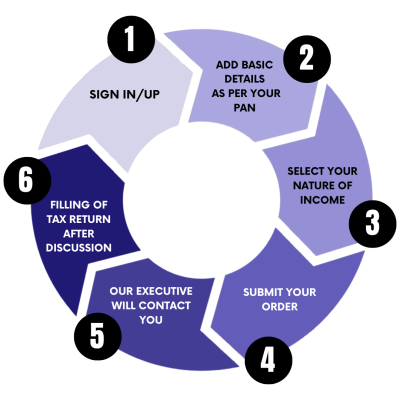

For OLA Driver TDS Refund, Follow the basic 3 steps below to file your Income Tax Return at Finance Suvidha Kendra for OLA Drivers and get your TDS Tax Refund in your bank account.

Steps For File Your ITR Now

3 Simple Steps to get ITR E-Filed after discussion with CA

File ITR & Get Your TDS Refund To Your Bank Account.

Any confusion about TAX Refund?

Talk to our Tax Experts and let them file your Income Tax Return

How can OLA Drivers file their Income Tax Return at Finance Suvidha Kendra?

OLA Drivers needs only their:

- PAN Card

- Aadhaar Card

- Bank account number and IFSC Code

All the other details will be taken by team of CA’s and Income Tax Experts at Finance Suvidha Kendra.

Do OLA drivers receive any other benefits from filing an income tax return beyond receiving a tax refund?

INCOME TAX REFUND

Shops and Business can get their TDS back into their Bank account. File Business ITR with Finance Suvidha Kendra and get maximum Income Tax Refund.

VISA PURPOSE

Embassies and Immigration consultant demands 3 years Business Income Tax Return. File 3 years Business ITR with Finance Suvidha Kendra

LOAN APPLICATION

Banks demands 3 years Business Income Tax Return to process Loan Applications . File 3 years Business ITR with Finance Suvidha Kendra

INCOME PROOF

Business ITR act as proof of your Income. which can be used in Insurance claims, buying High Value Properties etc. File Business ITR with Finance Suvidha Kendra

TAX COMPLIANCE

As per Income Tax Rules if your annual Income is more than ₹ 2,50,000/- , Shops and Business are required to file their Income Tax Return. File Business return with Finance Suvidha Kendra

How long will it take for the Tax Refund of TDS deducted by OLA to be credited to my bank account?

OLA Drivers’ ITRs are processed by the Income Tax Department within 7-10 working days. The Tax Refund may, however, take longer to arrive in the bank account of OLA Drivers in some cases

How do I file my income tax return as an OLA Driver?

There is no need to worry, the Finance Suvidha Kendra application is specifically designed for OLA Drivers to file their income tax returns and claim their tax refunds.

OLA drivers only need to submit their PAN and Aadhaar cards. Other work will be handled by a team of CAs and Income Tax Experts. Our goal is to provide a super easy way for you to claim your tax refund.

Frequently Asked Questions - OLA Driver TDS Refund

Ola Driver Partner

The requirements for becoming an Ola Driver Partner include a commercial driving license, a vehicle, and the necessary documentation. A flexible work schedule and the ability to earn income by driving are some of the benefits provided by Ola. When drivers register with the Ola app, they can accept rides, allowing them to work independently and manage their own schedules.

Ola Driver Customer Care Number

Ola Driver Partners can reach customer care for support and assistance at the dedicated helpline number. This number is available 24/7 to address any issues related to payments, trips, or app functionality. For quick resolutions, drivers can also access support through the Ola Partner app.

Ola Cab Driver Salary

Ola cab driver salary varies based on the number of trips completed, location, and working hours. On average, drivers can earn between ₹15,000 to ₹50,000 per month. Ola also offers incentives and bonuses for completing a certain number of rides, which can significantly increase earnings.

How Much Ola Deducts TDS From Their Partner's Salary?

Ola deducts Tax Deducted at Source (TDS) from their partner drivers' earnings at a rate of 1% under Section 194C of the Income Tax Act. This TDS is applicable to payments made to drivers if their total earnings exceed ₹30,000 in a financial year. The deducted TDS can be claimed while filing the driver's income tax return.

You Can Easily File Your TDS Returns Through FSK India Customer Portal!