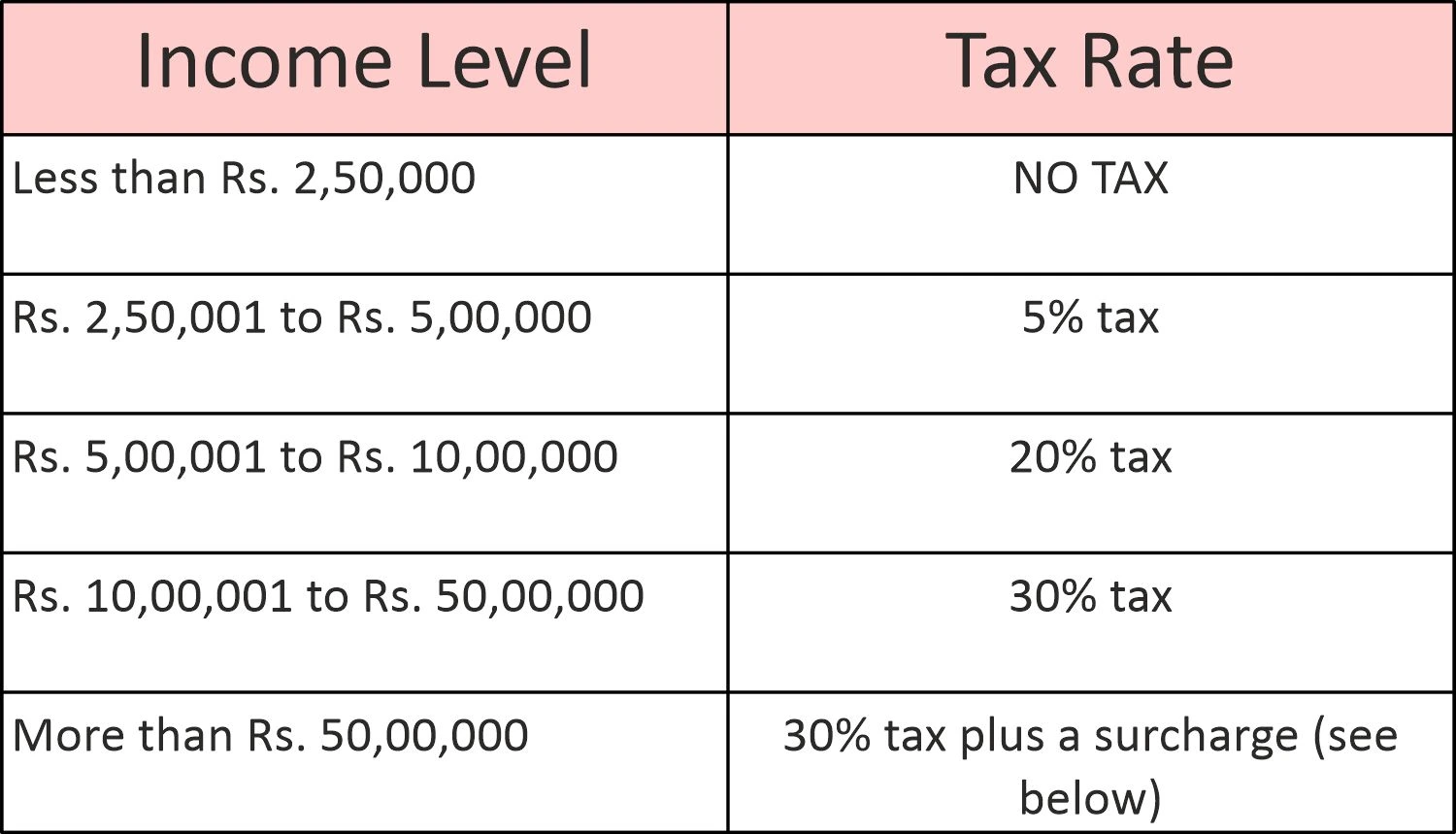

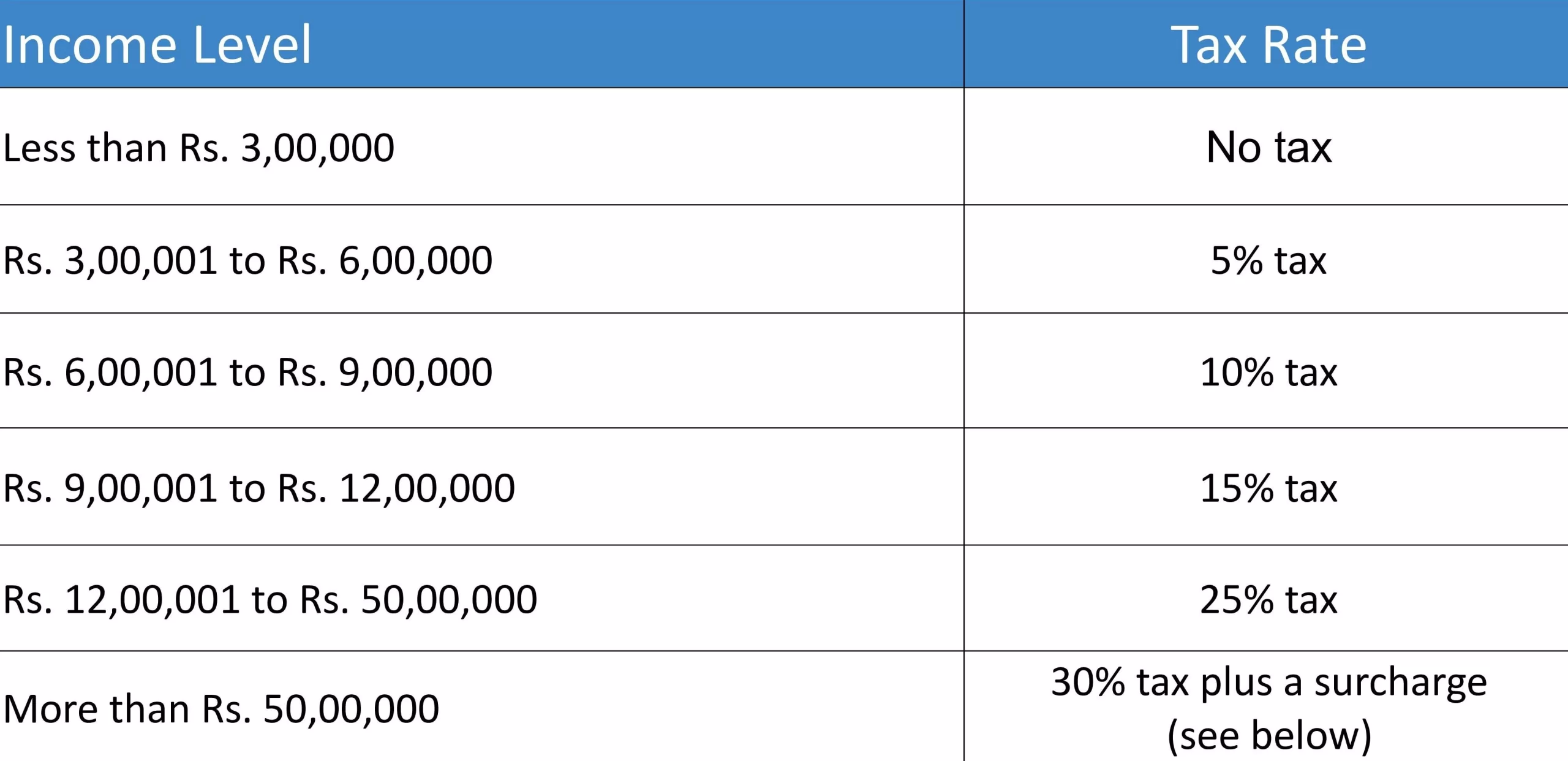

The Indian Income tax system has two ways (known as Tax regimes) to calculate taxes: the old regime with many deductions and Tax rebates, and the new regime with lower tax rates but fewer deductions. It’s important to know which tax slab you fall into under each system to plan your taxes correctly. Here’s a simple guide to the tax slabs for the A.Y 2024-25 financial year (which is the year 2024-25 in terms of income, in other words any income earned during the period of 1st APRIL 2023 TO 31ST MARCH 2024 will be taxed under A.Y. 2024-25)

However to make it easy and simple for you, we have made a simple and Free Income Tax Calculator AY 2024-25 (Financial Year 2024-25). This Simple and Free Income Tax Calculator AY 2024-25 will guide you on how to choose the best Tax regime (Old Tax Regime Vs New Tax Regime).

This Income Tax Calculator AY 2024-25 is suitable of every class of Income be It Salaried , Business Income, Agricultural Income , Rental Income or Other Source income.

Our team of Tax experts and CA’s at FSK India prepare your Income Tax Return in a best possible method to save your tax and maximise your Tax Refund.

File Income Tax Return Price starting at Just Rs 199/-

(Inclusive of all Taxes)

If your total income is more than Rs. 50 lakh, you’ll pay an extra 10% tax. If it’s more than Rs. 1 crore, you’ll pay an extra 15% tax. If it’s more than Rs. 2 crore, you’ll pay an extra 25% tax. For the 2024-25 financial year, the highest surcharge rate has been reduced from 37% to 25%.

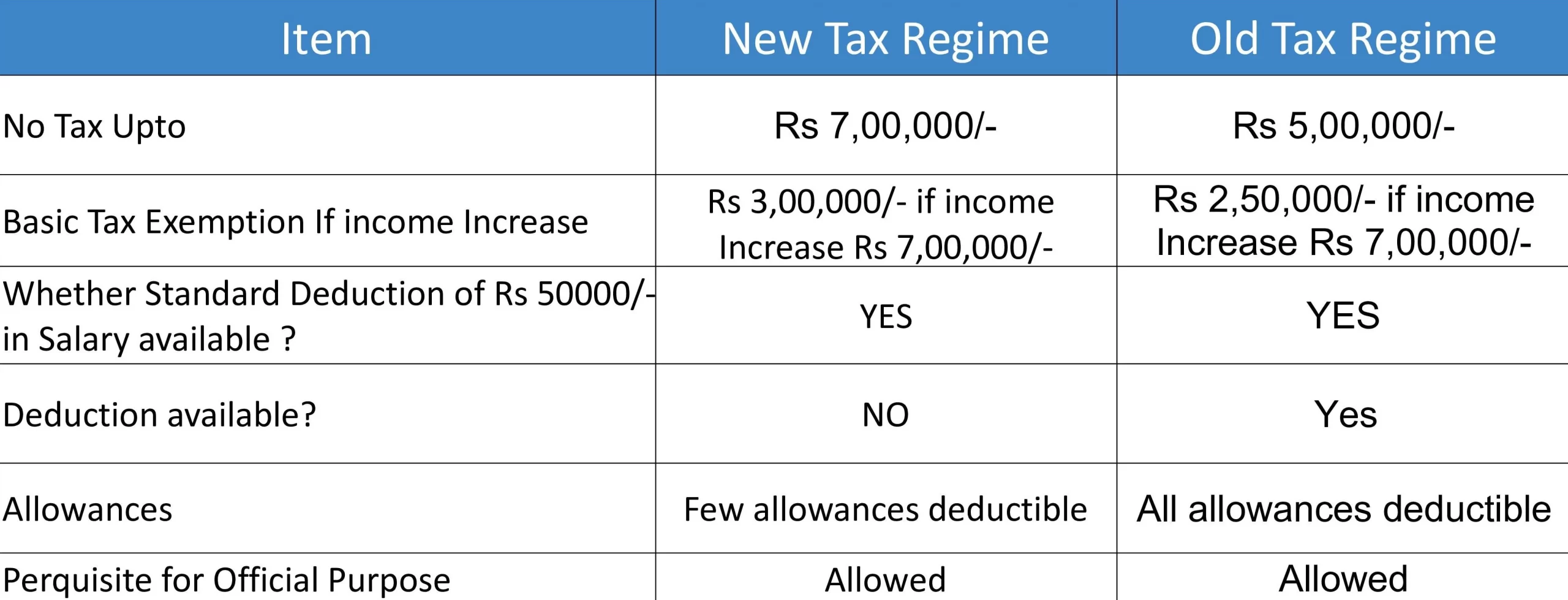

Both Tax regimes allow a standard deduction of Rs. 50,000 in case of Salary Income

Tax experts and CA’s at FSK India compare the both regimes according to your Income and choose the best suitable regime to save your taxes.

Each and every Income Tax Return is prepared by team of Tax experts and CA’s at FSK India.

Use our simple and free Income Tax Calculator AY 2024-25 and our free Income Tax Calculator AY 2024-25 will guide you to decide the best Tax regime according to your Income

It is not possible to give direct conclusion of which Tax regime is best for you?

However if you have savings and Investment please use our Simple and Free Income Tax Calculator AY 2024-25 to know which Tax regime is best for you. Else Choose New Tax Regime.

Our team of Tax experts and CA’s at FSK India prepare your Income Tax Return in a best possible method to save your tax and maximise your Tax Refund

Every case is different, however if your Income is upto Rs 750000/- from salary then both the regimes are same for you. In case your Income is above Rs 750000/- then we have to check each case. Use our Simple and free calculator to to find out the best tax regime for you.

If your Income is upto Rs 700000/- then we suggest you to choose New Tax regime, however if your income is above Rs 700000/- and have deductions under section 80C use our simple and free Income Tax Calculator ay 2023-24 to check which Tax regime is best for you

If your Income is from Business then you are not allowed to change the Tax regime from New Tax regime to Old Tax Regime. However, if your income is not from Business you are free to change the Tax regime from New Tax regime to Old Tax Regime. As per Income Tax Rules, Taxpayers are not allowed to change the regime form New to Old once opted.

If your Income is from Business then you are not allowed to change the Tax regime from New Tax regime to Old Tax Regime. However, if your income is not from Business you are free to change the Tax regime from New Tax regime to Old Tax Regime. As per Income Tax Rules, Taxpayers are not allowed to change the regime form New to Old once opted.

As per the Union Budget 2023, the New Tax regime will be default Tax regime for filling Income Tax Return. However if one wish to change the Tax regime can do so by filling form 10IE.

Let our Tax experts handle all the Tax return process for you and choose the best Tax regime

(Show File Now button) Price starting at just Rs 350/-(Inc. of All Taxes) per ITR.

Yes Standard deduction of Rs 50000 is available in New Tax Regime from A.Y. 2024-25.

Unfortunately Income Tax Department does not allow to change the Tax Regime while revising Income Tax Return. It is always better to choose the Best suitable Tax regime while filing Income Tax Return. To know which Tax regime is suitable for you Old Tax Regime or New Tax regime Click here to use our simple and Free Income Tax Calculator ay 2023-24.

Only contribution by employer is allowed as deduction u/s 80CCD(1B) in New Tax regime. Any other contribution to NPS is not allowed as deduction in New Tax Regime

If your Income is upto Rs 7,00,000/- we suggest you to choose the New Tax regime.

If your Income is upto Rs 7,00,000/- we suggest you to choose New Tax Regime.

We have a special offer for Zomato/Swiggy riders to file their Income Tax return and claim the Tax refund. Our Tax experts and CA’s will choose best Tax regime for you and claim Maximum Tax refund.

File Tax return now price Starting at Just Rs 350/-

The Income Tax Return is prepared by team of Tax experts and CA’s at FSK India compare the both regimes according to your Income and choose the best suitable regime to save your taxes.

Fsk India ensures that your there are no mistakes and error in Tax return and follow all the rules of Income Tax.