Lowest Pricing in India

Project Report for Bank Loan - By CA

Apply at lowest priced CMA Report and Project report for Bank Loan, Mudra Loan CC Limit and Startups. Project Report is prepared by CA to get loan from Banks.

Sample Project Report

Income Tax Calendar for Last Date of ITR Filling

[A.Y. 2024-25]

File ITR by CAs at just ₹399/-

Great! – With FSK India Get Your ITR Filed in Just 1 Day at ₹399/- only…

E-Filing Services Made Easy with Finance Suvidha Kendra

Nowadays, managing financial responsibilities like Income Tax Returns (ITRs) has become essential. The popularity of e-filing services has increased as more people realize the importance of filing their taxes accurately and on time. Finance Suvidha Kendra can assist you by giving E Filing Services, if you want to file your ITR and claim your Tax Deducted at Source (TDS) refund without hassle. No matter if you’re an individual taxpayer or a business owner, we make sure that your tax filings are completed quickly, correctly, and efficiently.

What is E-Filing Services?

The term e-filing refers to the process of submitting your taxes online rather than manually filling out forms and mailing them. It’s the fastest, most secure, and most convenient way to file your taxes. ITRs can be filed electronically through recognized platforms by individuals and businesses.

At Finance Suvidha Kendra, we provide advanced e-filing services that allow you to submit your tax returns instantly, claim your TDS, and stay compliant with tax regulations.

Benefits of E-Filing Services with Finance Suvidha Kendra

Convenience

E-filing with Finance Suvidha Kendra means you can submit your ITR from home or office. You no longer need to wait in long queues or deal with complicated paperwork. Our app and web portal streamline the entire process, saving your time and effort.Accuracy

Filing taxes manually can lead to errors that might cost you both time and money. With our e-filing services, our platform automatically calculates your tax liability and helps avoid common mistakes. Our system is designed to minimize errors and maximize accuracy.TDS Refund Claims

Many individuals are unaware that they can claim a refund for the excess TDS that has been deducted. Finance Suvidha Kendra not only helps you file your ITR but also ensures that you receive any TDS refunds that you’re eligible for.Expert Assistance

Taxes can be complex, especially for individuals who are unfamiliar with the process. At Finance Suvidha Kendra, our team of tax experts and chartered accountants is available to assist you at every step. Whether you need help with understanding tax laws, calculating deductions, or filing your ITR, our professionals are here to guide you.Fast Processing

Our e-filing services ensure that your ITR is processed swiftly. Once your return is filed, you can track its status online and receive notifications when your refund is approved or any additional information is required.Paperless Process

With e-filing, the entire process is paperless. All your documents, such as Form 16, investment proofs, and other income-related documents, can be uploaded directly to our portal. This not only saves paper but also keeps your information secure and organized.Secure and Confidential

At Finance Suvidha Kendra, we prioritize the security and privacy of your data. Our platform uses advanced encryption technology to safeguard your personal and financial information, ensuring that your sensitive details are protected throughout the e-filing process.

file your ITR hassle-Free!

Great! – With FSK India Get Your ITR Filed in Just 1 Day at ₹399/- only…

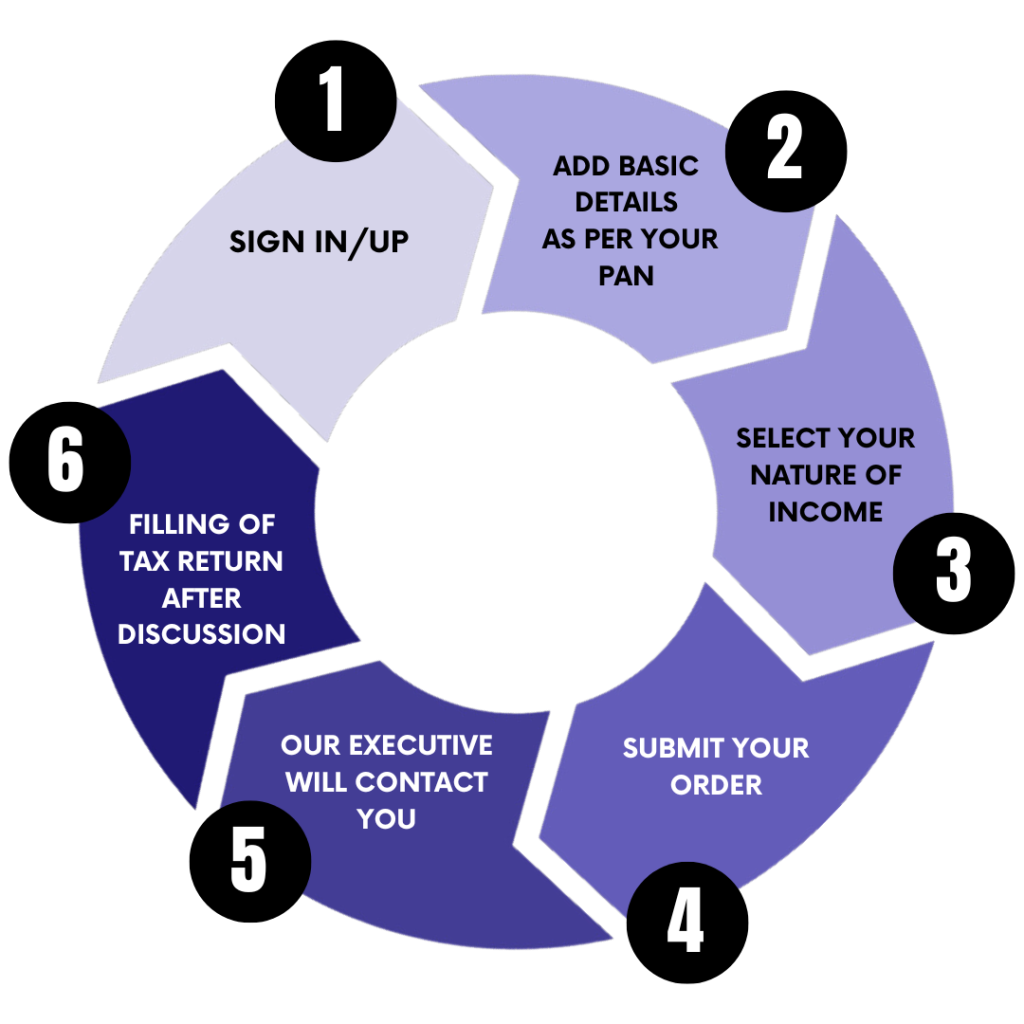

How to File Your ITR Through Finance Suvidha Kendra

Filing your ITR through Finance Suvidha Kendra is simple and user-friendly. Here is a step-by-step guide to help you navigate the process:

SIGN IN/UP for ITR filing.

ADD BASIC DETAILS AS PER YOUR PAN for ITR FILING.

SELECT YOUR NATURE OF INCOME.

SUBMIT YOUR ITR FILING ORDER.

OUR EXECUTIVE WILL CONTACT YOU FOR ITR FILING.

ITR FILING BY CA AFTER DISCUSSION WITH YOU.

01

SIGN IN/UP for ITR filing

02

ADD BASIC DETAILS AS PER YOUR PAN for ITR FILING

03

SELECT YOUR NATURE OF INCOME

04

SUBMIT YOUR ITR FILING ORDER

05

OUR EXECUTIVE WILL CONTACT YOU FOR ITR FILING

06

ITR FILING BY CA AFTER DISCUSSION WITH YOU

Who Should Use Our E-Filing Services?

Our e-filing services are perfect for:

Salaried Individuals: Easily file your ITR using Form 16 and claim deductions for investments, insurance, and more.

Freelancers & Professionals: Calculate your tax liability on income from freelancing or professional services.

Business Owners: Small and medium-sized business owners can file their ITR and claim deductions for business expenses.

Individuals Seeking TDS Refunds: If you have had excess TDS deducted on your salary or investment income, our platform can help you claim a refund quickly.

Best Support Service - ever!

FSK India Gives The Best Support Service To You, While Filing Your Income TAX Return’s.

Why Choose Finance Suvidha Kendra?

Providing e-filing Serivces, TDS refunds, and expert tax advice, Finance Suvidha Kendra is a trusted partner for individuals and businesses. With our commitment to customer satisfaction, ease of use, and secure processes, you can focus on what matters most.

By choosing Finance Suvidha Kendra, you are not only opting for a hassle-free ITR filing experience but also ensuring that you maximize your savings by claiming all eligible deductions and refunds.

Types of ITR Forms and Their Purpose?

In India, the Income Tax Department provides different ITR forms based on various types of income and taxpayer categories. It’s crucial to choose the correct form to ensure a smooth filing process. At Finance Suvidha Kendra, we help you identify the right ITR form for your needs. Here’s a breakdown of the most common ITR forms:

ITR-1 (Sahaj): Designed for salaried individuals with income up to ₹50 lakhs, income from one house property, and income from other sources like interest.

ITR-2: For individuals and Hindu Undivided Families (HUFs) not having income from business or profession but having capital gains, more than one house property, or foreign income.

ITR-3: For individuals and HUFs with income from business or profession.

ITR-4 (Sugam): For taxpayers opting for the presumptive income scheme under Section 44AD, 44ADA, or 44AE.

ITR-5 to ITR-7: For firms, LLPs, companies, and charitable trusts.

Our platform simplifies the process by selecting the correct ITR form for you, based on your income details. Whether you’re a salaried individual or a business owner, Finance Suvidha Kendra ensures that you file the correct form, avoiding unnecessary delays and rejections.

Common Deductions You Can Claim While E-Filing

Tax deductions reduce your taxable income, which in turn lowers your tax liability. Here are some common deductions you can claim, and Finance Suvidha Kendra helps ensure that you don’t miss any eligible benefits:

Section 80C: Deduction up to ₹1.5 lakhs on investments like Employee Provident Fund (EPF), Public Provident Fund (PPF), Life Insurance premiums, National Savings Certificates (NSC), and more.

Section 80D: Deduction for health insurance premiums for self, spouse, children, and parents.

Section 80E: Deduction on interest paid on an education loan for higher studies.

Section 80G: Deduction on donations made to charitable institutions or relief funds.

Section 24(b): Deduction on home loan interest payments, up to ₹2 lakhs.

At Finance Suvidha Kendra, our tax experts guide you through the process of claiming these deductions while filing your ITR, ensuring that you maximize your savings and stay compliant with tax regulations.

Understanding Form 16 and How to Use It?

Form 16 is a certificate issued by your employer showing details of your salary and the tax deducted at source (TDS) on your behalf. It’s a crucial document for salaried employees during the ITR filing process. Here’s how you can use it while filing with Finance Suvidha Kendra:

Part A: Contains details about the tax deducted and deposited with the government. It includes information like your PAN, employer’s TAN, and the TDS deducted.

Part B: Contains details about your gross salary, exemptions, deductions, and the net taxable income.

When you e-file with Finance Suvidha Kendra, simply upload your Form 16, and our system auto-fills the necessary details, ensuring an error-free submission. Our platform helps salaried individuals easily map income and tax details from Form 16 to their ITR forms.

Late Filing Penalties and How to Avoid Them

Filing your ITR after the deadline can lead to penalties under the Income Tax Act. These penalties can range from ₹1,000 to ₹10,000 depending on the delay. Here’s a breakdown of the penalties and how Finance Suvidha Kendra helps you avoid them:

Section 234A: Interest is charged for late filing if you have any tax liability. It is calculated at 1% per month on the amount of unpaid tax.

Section 234F: A late fee of ₹5,000 if the return is filed after the due date but before December 31, and ₹10,000 if filed later than that.

With Finance Suvidha Kendra, you receive timely notifications about upcoming deadlines, and our experts ensure your return is filed on time, avoiding these penalties. Even if you’ve missed the deadline, we assist you in filing a belated return and help minimize penalties as much as possible.

The Importance of Verifying Your ITR

After filing your ITR, it’s important to verify it. Without verification, your return will not be processed, and any refunds you’re due will not be issued. Verification can be done in two ways:

Electronically: Using Aadhaar OTP, net banking, or bank account validation through the e-filing portal.

Manual Verification: By sending a signed copy of the ITR-V (acknowledgment form) to the Income Tax Department’s Central Processing Centre (CPC).

At Finance Suvidha Kendra, we guide you through this crucial step. Our platform allows you to verify your return electronically in just a few clicks, ensuring that your ITR is processed without any delay.

Filing Revised Returns: How Finance Suvidha Kendra Can Help

If you discover an error in your filed return, the Income Tax Department allows you to file a revised return before the end of the assessment year. Here’s where Finance Suvidha Kendra comes to the rescue:

We help identify discrepancies in your original return.

Assist you in revising your ITR accurately.

Ensure the revised return is submitted before the deadline, avoiding any penalties.

Filing revised returns ensures compliance and prevents future scrutiny. Whether the error is in income details, deductions claimed, or even simple data entry mistakes, our experts at Finance Suvidha Kendra help you correct and re-file your return with ease.

Benefits of Filing ITR Even When It’s Not Mandatory

Filing an ITR is mandatory for individuals with income above a certain threshold, but even if your income is below this limit, there are several benefits to filing your return:

Claiming Refunds: If TDS has been deducted on your income, filing a return allows you to claim a refund.

Establishing Financial Proof: Filed ITRs act as proof of income when applying for loans, credit cards, or visas.

Avoiding Notices: Even if your income is below the threshold, you may receive a notice from the tax department if they detect TDS deductions. Filing your return proactively helps avoid such issues.

At Finance Suvidha Kendra, we encourage you to file your ITR, even if it’s not mandatory, to enjoy these benefits. Our platform makes it easy for individuals from all income levels to file their returns quickly and securely.

file your ITR hassle-Free!

Great! – With FSK India Get Your ITR Filed in Just 1 Day at ₹399/- only…

Conclusion - E-Filing Services

The e-filing services offered by Finance Suvidha Kendra simplify the entire process of filing taxes and claiming TDS refunds. With our user-friendly app and web portal, you can complete your tax filing in a few easy steps without leaving your house. You can count on our team of experts to assist you throughout the process, ensuring that your tax returns are accurate, timely, and error-free.

Finance Suvidha Kendra is your go-to solution for e-filing services, whether you’re an individual taxpayer, a business owner, or someone looking to claim a TDS refund. Get started today and experience the ease and convenience of filing your taxes online!

FAQ's - E-Filing Services

1. Income Tax India E-Filing Gov In E-Filing Services

The Income Tax India e-filing portal allows taxpayers to file their Income Tax Returns (ITR) online. However, the process can be time-consuming and complex. At Finance Suvidha Kendra, we offer easy-to-use e-filing services, simplifying the process so that you can file your taxes quickly and efficiently.

2. ITR Filing Services

At Finance Suvidha Kendra, we provide comprehensive ITR filing services, ensuring your returns are accurate and timely. Whether you’re salaried, self-employed, or a business owner, our platform allows you to file ITR effortlessly while claiming all eligible deductions and TDS refunds, guided by tax experts.

3. How to File ITR Online?

Filing ITR online is simple with Finance Suvidha Kendra. Register on our app or web portal, fill in your personal and income details, upload necessary documents, and submit your return. Our platform guides you step-by-step, ensuring error-free filing and quick submission, all from the comfort of your home.

4. ITR Filing Online

Online ITR filing is convenient and secure with Finance Suvidha Kendra. Our platform enables users to file their returns easily, claim deductions, and receive TDS refunds. Whether you're an individual or a business owner, we simplify the process, ensuring compliance with all tax regulations and timely submission.

5. How to File ITR Online by Self?

To file ITR online by yourself, gather your documents like Form 16, investment proofs, and PAN card. Register on Finance Suvidha Kendra’s platform, enter your income details, claim eligible deductions, and submit. Our easy-to-use interface ensures that even first-time users can complete the process smoothly.

6. How Can I Get a TDS Refund?

To get a TDS refund, file your Income Tax Return accurately, ensuring all deducted TDS is declared. At Finance Suvidha Kendra, we simplify the process by helping you file your ITR and track your TDS refund status. Once processed by the tax authorities, the refund will be credited to your bank account.

7. How to Get a TDS Refund?

Getting a TDS refund is simple with Finance Suvidha Kendra. After filing your ITR, we assist in claiming your TDS refund by ensuring that all necessary deductions are included. Once the Income Tax Department processes your return, the refund is directly credited to your bank account.

Index:

• E-Filing Services Made Easy with Finance Suvidha Kendra

• Benefits of E-Filing Services with Finance Suvidha Kendra

• How to File Your ITR Through Finance Suvidha Kendra

• Who Should Use Our E-Filing Services?

• Why Choose Finance Suvidha Kendra?

• Types of ITR Forms and Their Purpose?

• Common Deductions You Can Claim While E-Filing

• Understanding Form 16 and How to Use It?

• Late Filing Penalties and How to Avoid Them

• The Importance of Verifying Your ITR