139 9 of Income TAX Act : Rectify Defective Return ₹999

file your ITR hassle-Free!

Rectify your Defective ITR after discussion with Tax Experts in just ₹999/-

Section 139 9 of Income Tax Act

Filing income tax returns is a major responsibility for every taxpayer in India. The Income Tax Act, 1961, lays down various provisions to ensure consistency and simplify the process of filing returns. One such provision is Section 139(9) of the Income Tax Act, which deals with defective returns. In this article, we will explore into the details of Section 139(9), understand what makes up a defective return, the consequences of filing one, and the steps to rectify it. Additionally, we will discuss the importance of timely and accurate filing and how our company can assist you in filing your Income Tax Returns (ITR) seamlessly

5 Reason for Defective Return U/s 139(9) of Income Tax Act

- Non Reporting or Misreporting of Shares & Mutual Funds Sale Report

- Non Reporting or Misreporting of Online Lottery Income

- Non Reporting or Misreporting of Business Receipts/Professional Receipts

- Non Reporting or Misreporting of Salary Income

- Wrong Selection of ITR FORM

What Is Section 139(9) of the Income Tax Act?

Section 139(9) of the Income Tax Act refers to defective returns. A tax return is considered defective if it lacks essential information or supporting documents. The taxpayer is notified and given a chance to fix the defects within a specified period to avoid the return being rejected as invalid.

- Received Defective Return Notice?

- Rectify your Defective Return by CAs & Experts In just Rs.999/-

139 9 of Income TAX Act Common Reasons

A return may be declared defective for several reasons. Some common causes include:

Incomplete or Incorrect Information: Missing or incorrect details such as PAN, income details, deductions, or exemptions.

Non-Attachment of Mandatory Documents: Failure to attach necessary documents like Form 16, Form 26AS, or proof of deductions claimed.

Non-Compliance with Prescribed Forms: Not filing the return in the prescribed format or using outdated forms.

Non-Payment of Tax Due: Failure to pay the self-assessment tax before filing the return.

Incorrect Computation of Income: Errors in calculating total income or tax liability.

file your ITR hassle-Free!

Great! – With FSK India Get Your ITR Filed in Just 1 Day at ₹399/- only…

Consequences of 139 9 of Income TAX Act

Filing a defective return can lead to several problems:

Notice from the Income Tax Department: The AO will issue a notice under Section 139(9), specifying the defects and providing a deadline to rectify them.

Delayed Processing of Returns: Until the defects are rectified, the processing of the return will be delayed, leading to potential delays in receiving refunds.

Penalties and Interest: Failure to rectify the defects within the stipulated time may result in penalties and interest on the unpaid tax amount.

Rejection of Return: In extreme cases, the AO may reject the return, treating it as invalid, demanding the filing of a fresh return.

Rectifying 139 9 of Income TAX Act

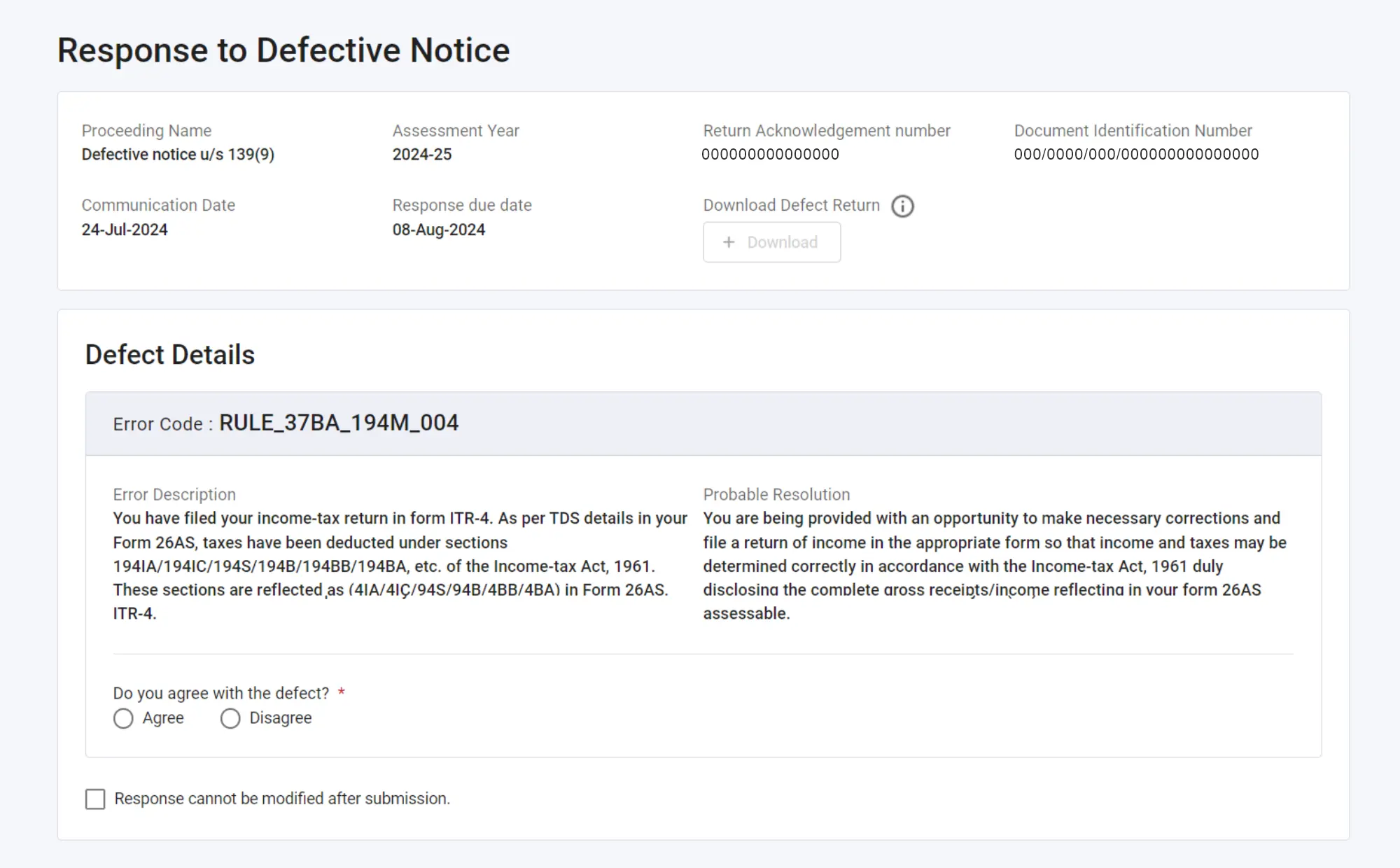

Step 1: Understanding the Notice

Upon receiving a notice under Section 139(9), carefully read and understand the defects pointed out by the AO. The notice will contain the details of the defects and the timeframe within which they need to be rectified.

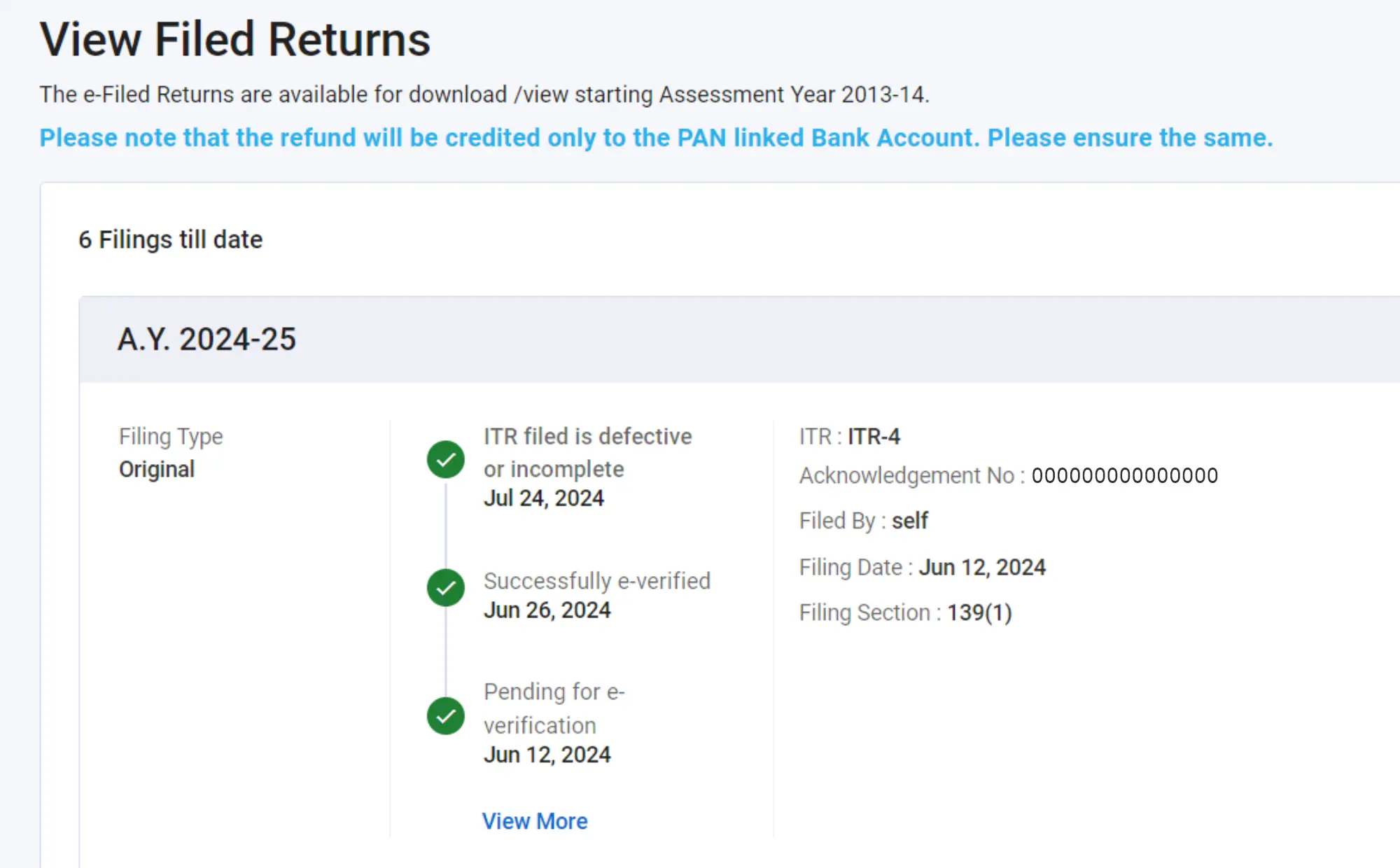

Step 2: Log in to the Income Tax e-Filing Portal

Visit the Income Tax e-Filing portal and log in using your credentials.

Step 3: Access the Notice

Navigate to the ‘e-Proceedings’ or ‘Pending Actions’ section to access the notice issued under Section 139(9).

Step 4: Rectify the Defects

Identify and rectify the defects as mentioned in the notice. This may involve correcting errors, providing missing information, or attaching necessary documents.

Step 5: Submit the Rectified Return

Once the defects are rectified, submit the rectified return on the e-Filing portal. Ensure that all corrections are made accurately to avoid further issues.

Step 6: Acknowledge the Submission

After submitting the rectified return, an acknowledgment will be generated. Save and print this acknowledgment for your records.

Best Support Service - ever!

FSK India Gives The Best Support Service To You, While Filing Your Income TAX Return’s.

Tips for Avoiding Defective Returns

Double-Check Information: Ensure that all details entered in the return are accurate and complete.

Attach Required Documents: Attach all necessary documents and proofs to support your claims.

Use Correct Forms: Always use the latest and prescribed forms for filing your return.

Pay Self-Assessment Tax: Pay any outstanding tax liability before filing the return.

Seek Professional Assistance: If you are unsure about the filing process, seek professional assistance to avoid errors.

The Importance of Timely and Accurate Filing

Timely and accurate filing of income tax returns is essential to avoid complications and penalties. It ensures compliance with tax laws and enables smooth processing of returns, leading to timely refunds and reduced scrutiny from the tax department. Moreover, it helps maintain a good tax record, which can be beneficial for future financial transactions and assessments.

How FSK can help in correcting the139 9 of Income TAX Act?

The FSK India app is developed by CAs & Tax Experts with experience of more than 10 Years. On FSK App you need to give basic details of your KYC and our Tax Experts will find the Defect and discuss with you at just Rs.999/-.

Expert Guidance: Our team of experienced tax professionals provides expert guidance on all aspects of tax filing, ensuring compliance with the latest regulations.

Accurate Filing: We meticulously review your financial information to ensure accurate filing, minimizing the risk of defective returns.

Timely Submission: We ensure timely submission of your returns, helping you avoid penalties and interest.

Document Management: We assist in managing and attaching all necessary documents, ensuring a complete and compliant return.

Resolution of Notices: In case of any notices from the tax department, we provide prompt assistance in rectifying defects and resolving issues.

Introducing TAX Filing Services: A Hassle-Free Alternative

The Income Tax Portal is helpful, however it’s annoying when there are technological issues. Think about TAX Filing Services if you want things to go more smoothly and reliably. With the many advantages of our platform Finance Suvidha Kendra is the ease with which taxpayers can file their taxes:

1. User-Friendly Interface

Our platform is easy to navigate, ensuring that you can file your taxes without any hassle.

2. One – Day ITR Filing

At FSK India your ITR will be file at the same day as you make your order, by our CA’s & TAX Exerts.

3. High Quality Customer Support Service

We give a high quality support to our customers who file their ITR from our FSK India Customer Portal.

4. Secure Data Handling

We prioritize your data security with advanced encryption and secure storage solutions to protect your personal information.

5. Timely Updates

Stay informed with the latest tax regulations and updates through our platform, ensuring compliance and optimizing your tax filing process.

How to Get Started TAX Filing With FSK India?

There Is Only 6 Simple Steps to Follow and get your ITR Filed at just 1 Day…

Step - 2

Add Basic Details As Per Your PAN Card

Step - 3

Select Your Nature Of Income

Step - 4

Submit Your ITR Filing Order

Step - 5

Select Your Nature Of Income

Step - 6

Submit Your ITR Filing Order

By choosing FSK India for Filing Your ITR, you can avoid the common pitfalls of the Income Tax Portal and enjoy a streamlined, efficient tax filing experience. Visit our website today to learn more and get started.

file your ITR hassle-Free!

Great! – With FSK India Get Your ITR Filed in Just 1 Day at ₹399/- only…

Conclusion - 139 9 of Income TAX Act

Section 139(9) of the Income Tax Act ensures the accuracy and completeness of income tax returns by addressing defects promptly. Understanding its provisions and rectifying defective returns in a timely manner can save taxpayers from penalties and delays. Accurate and timely filing is essential for smooth tax processing and compliance. If you need expert assistance with your income tax returns, visit our website TAX Filing Services for professional guidance and a seamless filing experience. Trust our dedicated team to handle your tax matters with accuracy and care, ensuring a hassle-free process.

FAQ's - 139 9 of Income TAX Act

What is Section 139(9) of the Income Tax Act?

Section 139(9) deals with defective returns, identifying returns that lack mandatory information or documents. Taxpayers receive a notice to rectify defects within a specified period, ensuring compliance and accuracy in tax filings.

What is Section 139(9) of the Income Tax Act in Hindi?

आयकर अधिनियम की धारा 139(9) त्रुटिपूर्ण रिटर्न से संबंधित है। इसमें वे रिटर्न शामिल हैं जिनमें आवश्यक जानकारी या दस्तावेज़ नहीं होते। करदाताओं को त्रुटियों को सही करने के लिए नोटिस मिलता है और एक निर्दिष्ट समय सीमा के भीतर सुधार करने का अवसर मिलता है।

What is a defective return?

A defective return is one that lacks required information or documentation, or is filed incorrectly. The Income Tax Department issues a notice to the taxpayer to rectify the defects within a given timeframe, ensuring accurate and complete filings.

How much period is allowed to rectify defective Return notice u/s 139 9 Income Tax act?

The notice gives period of 30 days to rectify the defect and upload correct ITR form.

What if I don’t response to defective return notice u/s 139 9 Income Tax act?

If you don’t response to defective return notice, then you may face following consequences-

- Penalty- You may receive further notice from income tax for not filing return and pay penalties according to your income.

- No Refund - You will not receive any refund due if claimed in return.

- No Income Proof - You will not have income document proof which can help you in Loan , Visa, Insurance etc.

Index: