Income Tax Calendar for Last Date of ITR Filling

[A.Y. 2024-25]

File Your Last Three Year ITR!

Great! – With FSK India Get Your Last Three Year ITR Filing!

ITR Filing Online in Chandigarh

Nowadays, managing your finances can be a challenging process, especially when it comes to preparing your Income Tax Returns (ITRs). As tax laws are constantly changing and complex, individuals and businesses alike often find it difficult to file their returns on time and accurately. That is where Finance Suvidha Kendra comes in to make your ITR filing experience in Chandigarh hassle-free. By working with our team of Chartered Accountants (CAs) and Tax Experts, we ensure that your tax returns are filed accurately, comply with all legal obligations, and maximize your savings.

With our user-friendly Playstore app and a suite of comprehensive financial services, we offer a seamless online platform that covers everything from ITR filing to TDS refunds. Finance Suvidha Kendra provides tax-related services in Chandigarh, whether you need to file your last three years’ ITRs or claim your TDS refunds.

Why ITR Filing is Crucial?

As a salaried individual, business owner, or freelancer, filing your income tax return is more than a legal requirement, it also reflects your financial discipline.

Avoid Penalties: Failure to file your ITR on time can result in penalties from the Income Tax Department.

Loan Approval: The receipts for your ITR are used to identify your income, which makes it easier for you to obtain a home loan, a vehicle loan, or a personal loan.

Visa Processing: The ITR receipt is required by many countries for visa processing, especially for long-term or business visas.

Tax Refunds: By filing an ITR, you can claim tax refunds if you have paid more tax than you have to pay.

Carrying Forward Losses: Capital losses can be carried forward for up to eight years, so they can be offset against future gains.

Finance Suvidha Kendra: Your Trusted ITR Filing Partner

Our mission at Finance Suvidha Kendra is to assist people in filing their taxes in a simple, accurate, and stress-free way. Here’s how we can help:

Expert Assistance by CAs and Tax Experts:

The ever-evolving financial landscape in India makes tax filing difficult. Our highly qualified Chartered Accountants (CAs) and Tax Experts will handle your tax filing.

Accurate calculation of taxable income.

Proper deduction of eligible expenses.

Compliance with the latest tax laws and regulations.

Whether you’re filing ITR for salaried income, business income, or rental income, our team ensures that you make the most of the available deductions, exemptions, and tax-saving provisions.

Last 3 Years ITR Filing:

Is your ITR for the previous years not filed? No worries! At Finance Suvidha Kendra, we can file your ITRs for the last three years on your behalf. This is especially beneficial for individuals who may have missed filing in the past and now wish to get compliant without facing heavy penalties. We can help you file previous year’s returns and avoid complications with the Income Tax Department regardless of your status: salaried employee, business owner, or freelancer.

TDS Refund Processing

We can assist you with claiming a refund if you have excess TDS deducted from your income but failed to claim it because of improper filing.

Review your Form 26AS (TDS statement) for accuracy.

Help you file an accurate return.

Facilitate the quick and timely processing of your refund.

Our goal is to help you get your hard-earned money back without the stress of dealing with tax authorities.

file your ITR hassle-Free!

Great! – With FSK India Get Your ITR Filed in Just 1 Day at ₹399/- only…

ITR Filing Online In Chandigarh: How Finance Suvidha Kendra Makes It Easy

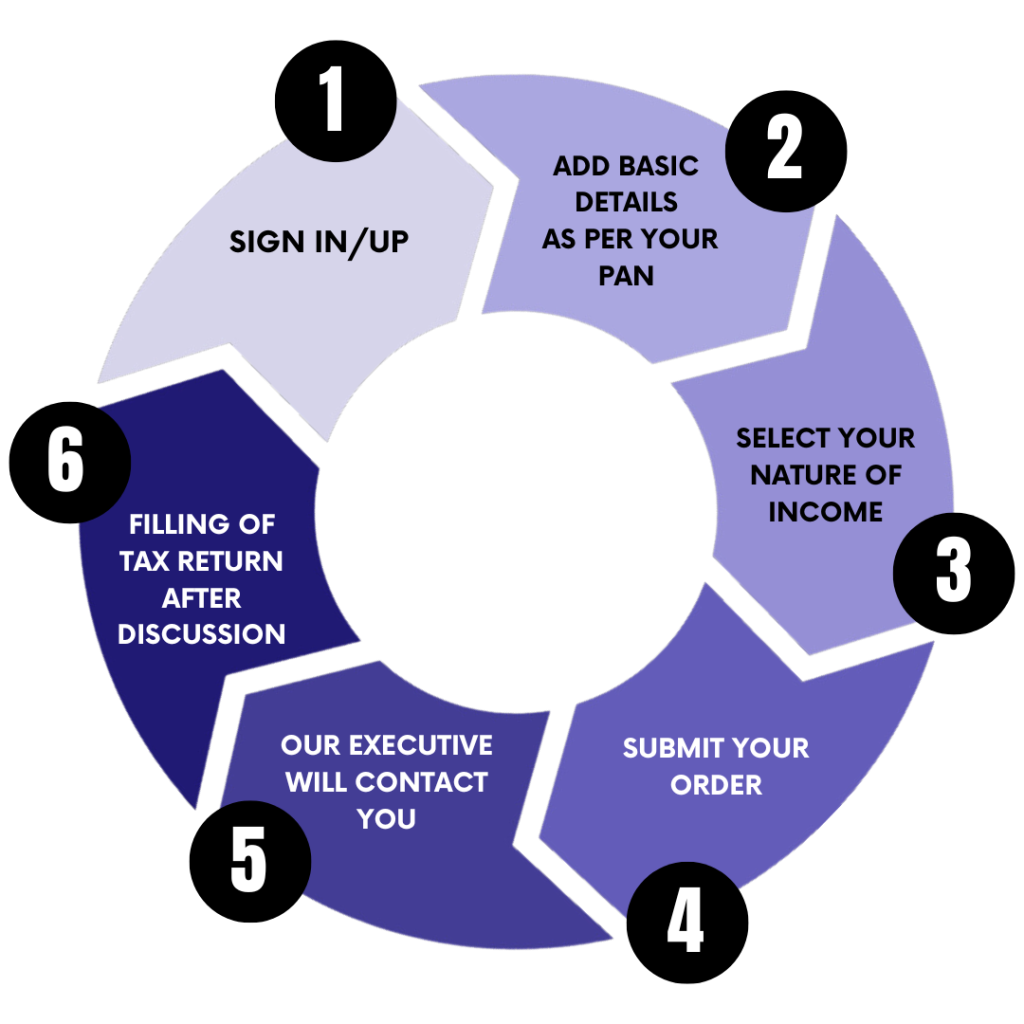

SIGN IN/UP for ITR filing.

ADD BASIC DETAILS AS PER YOUR PAN for ITR FILING.

SELECT YOUR NATURE OF INCOME.

SUBMIT YOUR ITR FILING ORDER.

OUR EXECUTIVE WILL CONTACT YOU FOR ITR FILING.

ITR FILING BY CA AFTER DISCUSSION WITH YOU.

01

SIGN IN/UP for ITR filing

02

ADD BASIC DETAILS AS PER YOUR PAN for ITR FILING

03

SELECT YOUR NATURE OF INCOME

04

SUBMIT YOUR ITR FILING ORDER

05

OUR EXECUTIVE WILL CONTACT YOU FOR ITR FILING

06

ITR FILING BY CA AFTER DISCUSSION WITH YOU

ITR Filing Online in Chandigarh: A Growing Hub for Financial Services

As a booming city with a rapidly growing population of professionals, entrepreneurs, and businesses, Chandigarh is becoming a significant financial services hub. Since the city is strategically located, close to IT parks, and has a high literacy rate, many individuals and businesses need professional tax services. No matter if you’re a salaried employee, running a startup, or running a well-established business, filing your ITR is crucial to staying compliant.

At Finance Suvidha Kendra, we recognize this growing need and offer specialized tax filing services specifically for the residents of Chandigarh. Our goal is to provide a one-stop solution for all your tax-related concerns.

Best Support Service - ever!

FSK India Gives The Best Support Service To You, While Filing Your Income TAX Return’s.

Finance Suvidha Kendra's App: Tax Services at Your Fingertips

The modern world is driven by technology, and we’ve adapted to meet the needs of today’s digital generation. Our mobile app, available on the Google Playstore, brings financial convenience right to your smartphone. With a few clicks, you can:

File your ITR.

Track your TDS refund status.

Access last year’s returns.

Consult with a tax expert.

The app’s user-friendly interface is designed to make the entire process smooth and easy, even for individuals who may not be familiar with tax filing. With everything accessible on your phone, tax compliance has never been easier.

file your ITR hassle-Free!

Great! – With FSK India Get Your ITR Filed in Just 1 Day at ₹399/- only…

Conclusion - ITR Filing Online in Chandigarh

You don’t have to worry about filing your Income Tax Return. Our goal at Finance Suvidha Kendra is to make tax filing simple, accurate, and stress-free for Chandigarh residents and businesses.

With a team of CAs and tax professionals to guide you every step of the way, you can trust us to handle your tax filing needs efficiently and accurately.

Download our app or visit our website today for hassle-free and professional ITR filing in Chandigarh. With Finance Suvidha Kendra, you can focus on what matters most—growing your wealth and securing your financial future—not your taxes.

FAQ's - ITR Filing Online In Chandigarh

1. How to File ITR Online in Chandigarh?

Filing your Income Tax Return (ITR) online in Chandigarh has never been easier with the Finance Suvidha Kendra app. The platform provides a seamless process for individuals, business owners, and salaried professionals to file their ITRs from the comfort of their homes. All you need is to download the app, create an account, and upload the required documents. Finance Suvidha Kendra's team of CAs and tax experts handle the rest, ensuring that your ITR is filed accurately and promptly. This hassle-free approach is perfect for busy professionals in Chandigarh who want to stay compliant with tax regulations without visiting any offices.

2. How Can I File ITR Online in Chandigarh?

To file your ITR online in Chandigarh, you can use the Finance Suvidha Kendra app, which simplifies the entire tax filing process. First, sign up for the app and provide basic details like your PAN number and income sources. Then, upload the necessary documents such as Form 16, proof of deductions, and any other relevant financial data. Once uploaded, the app's team of certified tax professionals will review and process your submission. Finance Suvidha Kendra ensures that the filing is done correctly and within the due dates, saving you from potential penalties.

3. How to File ITR Online Step by Step?

Filing ITR online can be done step-by-step using Finance Suvidha Kendra's user-friendly app. Start by downloading the app and registering for an account. Next, fill in your personal details, such as PAN and bank information. Then, upload your income-related documents, like Form 16 for salaried employees or financial statements for business owners. Finance Suvidha Kendra's experts will review your documents, calculate your tax liability, and ensure all deductions are considered. Finally, your ITR will be filed electronically with the Income Tax Department, and you will receive an acknowledgment for your records.

4. How to File ITR Online by CA?

With Finance Suvidha Kendra, you can file your ITR online through certified CAs, ensuring that your returns are accurate and compliant with the latest tax regulations. Simply download the app, create your account, and submit your documents. The app connects you with experienced CAs who specialize in handling complex tax scenarios, whether you're filing as a salaried individual, business owner, or freelancer. These professionals will review your financials, apply all applicable deductions, and file your ITR on your behalf. This expert-driven approach ensures peace of mind and accuracy in filing.

Join Today and Get Your TAX Refund!

Get Call Back From TAX Experts!

Fill out the form below, and we will be in touch shortly.

- This Offer Is Available for all CSC Centers And Internet cafe's

Latest Offer! File Your First ITR at Just ₹1/- Only...

- FLAT 50% OFF for Retailers Self ITR